Top 10 Stock Investing Books Of All-Time

| 1. |  |

The Intelligent Investor: The Definitive Book On Value Investing, Revised Edition: Hands down the first book you should ever read if you’re planning to invest in stocks! |

| 2. |  |

Security Analysis: The Classic 1940 Edition: The most detailed book that I’ve ever read that explains how to invest in stocks. It goes over the financials, how to read SEC filings, how to analyze a company. Everything is in detail, therefore this is not a light reading, but what you get out of it is worth it’s weight (it’s a heavy book). |

| 3. |  |

The Essays of Warren Buffett : Lessons for Corporate America: There’s nothing like reading directly from the richest person ever who made his fortune by investing in stocks! This is a collection of many of his best pieces, grouped together into topics. |

| 4. |  |

The Warren Buffett Way, Second Edition: A very good introduction on what to look for in stocks. Almost like a follow-up to The Intelligent Investor mentioned above as the #1 stock investing book. |

| 5. |  |

How to Lie With Statistics: If you’re going to invest in stocks, you need to be able to read graphs, there’s no doubt about it. The key however is that you need to understand how to properly read graphs because it’s very easy to manipulate their meaning by simple modifications (with the exact same data)! |

| 6. |  |

A Random Walk Down Wall Street: Anyone who’s educated themselves in stocks knows there are many investing philosphies and styles. This book goes through many of the more common ones and tries to determine which is better. In case you’re curious, the author believes that throwing a dart to pick your stocks gives you just as good of odds over the long term as any investment strategy. I don’t believe this, but he makes a very compelling case. |

| 7. |  |

Take On the Street: What Wall Street and Corporate America Don’t Want You to Know: I recommend this book not for its overall content, but for the great take aways on how the mutual fund market works. I was never fond of the mutual fund market, and now I know for sure that I’ll never invest in mutual funds. |

| 8. |  |

Reminiscences of a Stock Operator: This is the disguised story of the stock speculator Jesse Livermore from long ago who used shady practices to make and lose a lot of money. What’s good about this book is that it’s got an interesting perspective on when to buy, sell, or hold a position in any investment vehicle. |

| 9. |  |

Buffett : The Making of an American Capitalist: The best way to be successful at anything it to learn from the best, and Warren Buffett has consistently shown himself to be the most profitable stock investor in the world. Therefore no list would be complete without his biography, and this is the best one I’ve read about him. |

| 10. |  |

When Genius Failed : The Rise and Fall of Long-Term Capital Management: This is the real story of a group of individuals that over leveraged themselves on their investments and almost collapsed the market. I recommend this book not because of it’s entirety, but because there are some great nuggets of wisdom spread throughout. |

Permalink to this article Discussions (11)

How to Generate Traffic for Your Website

I’ve been asked to be one of 3 keynote speakers/instructors in a 4-day intensive training class on how to generate passive income online. The course will be held here locally in Ottawa over 2 weekends (the weekends of August 12-13 and 19-20). Spacing is very limited, it’s already 50% sold out and it was only annouced yesterday! Anyone interested should contact Glenn Scott before the August 4th deadline to register. The cost of attending is $250/person, which is phenomally low considering that you get 3 speakers for substantially less than it would cost you to just have one of them speak individually!. This is a one-time opportunity, this course will only be offered this one time.

As an extra, this course will be recorded for resale later on DVD. I’ve already made arrangements with Glenn Scott to be able to resell the DVD here through FollowSteph.com, so if you’re not able to come, you can always purchase a DVD copy here when it becomes available. The price of the DVD has not yet been determined.

The course will cover 4 major topics:

Web design

This will by taught by Michael VanDusen who is the head of web design at Algonquin College here in Ottawa. He will use Dreamweaver MX as a tool for building websites which includes lab time (individual computers will be available during the lab time).

Google Adsense Revenue

Glenn Scott will teach how to generate passive income using Google Adsense on your websites. Although he has several streams of income (real estate properties, etc.), Google Adsense is what has allowed him to become financially free at the level he wants.

SEO (Search Engine Optimization)

Glenn Scott wil also cover SEO principles which is very important in getting your site recognized and highly ranked by all the major search engines.

Traffic Generation (my section)

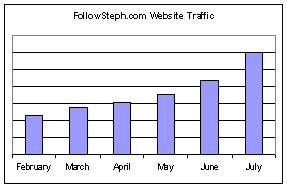

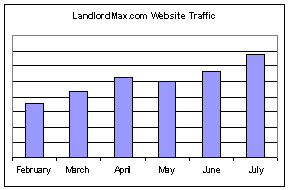

I will personally show you how to generate traffic to your website, be it for monetization, for a small business, etc. I will cover many topics such as blogging, how to get links to your website (link baiting), how to create valuable content, concepts online social networks, copywriting, Google Adwords, press releases, and so on. Basically I’ll show you many ways I’ve learned to make LandlordMax Property Management Software and FollowSteph.com grow in traffic to where they are today (they’ve both at least doubled in the last 6 months alone as shown in the graphs below).

To give you a little history, the concept for this course was actually born from a dinner I attended that was hosted by Glenn Scott entitled “How I Got Out of the Rat Race”. During this dinner many people were interested in learning more details on how he managed to become financially free and suggested he offer a course. And thus 4 weeks later this course was officially offered for this one and only time.

I’m very excited about this project! Not only will I be speaking/instructing one component of the course, but I will be donating my personal time for the other 3 course days to help Glenn and the other speakers/instructors with their components. I will field questions, help with lab times, etc. as I’m also very familiar with these topics. It’s a great opportunity to take advantage of several experts under one umbrella.

I look forward to seeing several of you there!

Permalink to this article Discussions (6)

Cities With the Highest Percentage of Millionaires

Phoenix Marketing International just released a study and found that New Mexico’s Los Alamos has the highest concentration of millionaires living in one city. Almost 1 in 10 residents of Los Alamos is a millionaire! Think about that, at any one point in time, almost every store in the local mall probably has a millionaire in it (assuming there is an average of 10 customers in each store).

Here’s are the top 10 cities with the highest percentage of millionaires:

.

| City | Millionaires |

|---|---|

| Los Alamos, N.M. | 9.7% |

| Naples/Marco Island, Fla. | 8.6% |

| BridgePort/Stamford/Norwalk, Conn. | 7.2% |

| Vero Beach, Fla. | 7.2% |

| San Jose/Sunnyvale, Calif. | 6.9% |

| Sarasota/Bradenton/Venica, Fla. | 6.7% |

| align=”left”Easton, Md. | 6.7% |

| Hilton Head Island/Beaufort, S.C. | 6.6% |

| San Francisco/Oakland, Calif. | 6.4% |

| Honolulu, Hawaii | 6.4% |

.

Permalink to this article Discussions (2)

Free LandlordMax Real Estate Property Analyzer Online Tool is Now Available!

I’m very excited to announce that last night we launched a new and FREE real estate property analyzer online tool on LandlordMax. This is a great tool, and I would wager the most in-depth tool of this type that you can find online! It doesn’t just create a simple amortization table for you, it creates 7 major reports, including: Amortization Table, Yearly Income Versus Expenses, Yearly Cash Flow, Property Appreciation Versus Debt, Cash on Cash Return, Net Operating Income (NOI), and Debt Coverage Ratio.

What’s really great about this tool is that it also takes into consideration several variables that you enter when calculating all of the reports, variables such as vacancy rate, annual property appreciation rate, annual income/expense growth rates, and so on. It also gives you the option to put in one time capital expenditures, custom yearly expenses, and so on.

As you can see, this is an in-depth real estate property analyzer, especially considering it’s free!

I’d also like to take a minute to thank everyone who’s helped us test it. As well, I’d like to especially thank two individuals who provided me with exceptional feedback. They are Glenn Scott (a local real estate investor and founder of Symbiotic.com) and Albert Boudreau (founder of Ideal Property Management). Thank you!

Please let me know what you think of it. If you have any comments or feedback, I’d be more than happy to hear about it. And don’t forget to let your fellow real estate investors know about it!

The link is: https://www.landlordmax.com/real-estate-analyzer

Permalink to this article Discussions (2)

Interview with John Lusk (The Mouse Driver Chronicles)

Several weeks ago I posted an entry about the book “The Mouse Driver Chronicles” which I’d read and really enjoyed. Since then I’ve been in contact with the authors of the book, in particular John Lusk. In one of our last email exchanges I asked him if he would be interested in an email interview and he accepted my offer. But before I get to the interview, let me give you a brief introduction about John, especially for those of you who aren’t yet familiar with the book.

Several weeks ago I posted an entry about the book “The Mouse Driver Chronicles” which I’d read and really enjoyed. Since then I’ve been in contact with the authors of the book, in particular John Lusk. In one of our last email exchanges I asked him if he would be interested in an email interview and he accepted my offer. But before I get to the interview, let me give you a brief introduction about John, especially for those of you who aren’t yet familiar with the book.

The book “The Mouse Driver Chronicles” is the story of John Lusk and Kyle Harrison, both graduates from the Wharton school of business, who decided to start their own bootstrap company at the very height of the dot com mania. At the time, to their fellow graduates, this seemed very odd (remember this was at the height of the dot com era). They skipped out on some very lucrative offers to start their company Mouse Driver, a company whose sole product was a computer mouse in the shape of a golf club driver. The book is their story of coming up with the idea, creating the product, manufacturing it, marketing and selling it, and all the possible road bumps they encountered on the way of which there were many! This story even became reading material for some college business classes. I personally enjoyed their story very much and I’d recommend it to everyone.

Now that you have an idea of who John is, although trust me when I say that a paragraph doesn’t do justice to reading the book, here are interview questions I sent him and his replies to them:

Hi John. I’ve been thinking about which questions to ask you and of course the most obvious is what’s happened since the book was published? How is company growing? Is there a Mouse Driver 2 product in the works? What’s happened to the two of you?

We sold the company to a large gift distributor on the East Coast in late 2003. Our exit strategy was always to sell the assets of the company and that’s what we did. Before we sold, we put together a few MD II prototypes that were a bit more ergonomic, utilized USB vs. PS2 and had a more sleeker design. At the time of sale, we turned over these prototypes to the acquiring company.

How has the book “The Mouse Driver Chronicles” impacted your lives and your company?

The book as been a very positive impact on our lives. Not only can we say that we’ve written a book, but our story continues to inspire, motivate and educate people all over the world. It’s been published in Korea, Taiwan, China and the UK and is required reading in over 100 universities/MBA programs in the US. We receive emails weekly from people who have been impacted by the book and just knowing that we’re helping others b/c of our story is just phenomenal.

Having read the book and the Insider Newsletters I found there was a lot of great information about succeeding and starting a business. If you had to give one piece of advice for someone going through it, what’s the one piece of advice you would give them?

You’ve got to believe in yourself and your company. As soon as you start having doubts, it’s time to get out.

Seeing you had a lot of difficulty early on in getting a mentor, what advice can you now give people in this regard?

Get a mentor or an advisor!! Do whatever it takes to find at least one person who can help you through some of the decision making. We never brought an official mentor on board and we paid for it.

From your book I gathered that you highly valued social networking. It seems to have been a substantial factor in your success. What advice can you give entrepreneurs in this respect?

I think that networking in general is always a good thing…but you’ve got to have a purpose in terms of why you’re networking and who you’re networking with. My biggest advice is to make sure that you make in networking ‘meeting’ beneficial for both parties. Put yourself in a position where you can also help the person that you’re networking with.

You mentioned to me in a prior email that you were planning on starting up the Insider Newsletter again, is this for certain? I know I enjoyed reading them, as I’m sure many of my readers here too did, which leads me to ask you when do you think the next one will sent out?

I’m still planning on it, but it needs to be the right time and moment. Right now, at Microsoft, what I’m doing from a work perspective wouldn’t make for very exciting reading (smile).

I noticed in the book you were fans of Guy Kawasaki (which I am too). Other than his online blog, what other online resources would you suggest your fellow entrepreneurs look to for getting information and advice (other than the Insider Newsletter of course) on running their businesses, marketing, sales, etc.?

We utilized Inc.com for a bunch of our stuff and marketingprofs.com to help marketing creativity

What do you believe the future hold in store for you? Do you still see MouseDriver as just a stepping stone or has it grown to more than that?

MouseDriver as a company is pretty much done. The book continues to do well but overall, the entire experience was just a stepping stone. Both Kyle and I are taking reprieves and work at Google and Microsoft respectively. We’re both that the skillsets and experiences that we’re gaining will help with whatever career move we make next.

I’d like to say that I thoroughly enjoyed reading your book “The Mouse Driver Chronicles“. Is there any chance that we’ll see a second “The Mouse Driver Chronicles 2” book?

🙂 I plan on writing another book….just need to figure out what it’s going to be about!

Thank you John for taking the time to answer all of my questions, it’s very appreciated. I wish you and Kyle the best success in the future and many other successful endeavours. And please let me know when you publish another book, I’ll be very interested in reading it!

Permalink to this article Discussions (11)

Life Quotes

Today is going to be a little different than usual. Today I’m going to pass on to you two quotes that I personally find very powerful, in business, in software development, in real estate, and in life in general.

Today is going to be a little different than usual. Today I’m going to pass on to you two quotes that I personally find very powerful, in business, in software development, in real estate, and in life in general.

Without further ado, the first quote:

“People are always blaming their circumstances for what they are. I don’t believe in circumstances. The people who get on in this world are the people who get up and look for the circumstances they want, and if they can’t find them, make them.”

– George Bernard Shaw

This is the most powerful quote for me. The reality is that life doesn’t always deal you a great hand. It’s not the hand your dealt that’s as important as how you play it. It’s much like the other famous quote “It took me 10 years to become an overnight success”. People forget that a lot those who made it didn’t have an easy path. They chose to take the hard path, they made the sacrifices, they took the chances (financially, emotionally, etc.), they put themselves out there. Just think of Rollerblades. I’ve heard I don’t know how many people say they thought of the idea before they came out, and there’s nothing wrong with that. But you know what, however true that is, unless you made the jump and did the 99% perspiration to get the idea going, an idea remains just that, an idea. You need to create your luck, you need to create your own circumstances that will let you get ahead!

Darren Rowse of Problogger.net recently wrote a very good article entitled “How to be lucky“. He virtually comes to the same conclusion, luck only comes to those looking for it.

The second quote is from the Navy Seals mantra when training for close quarters combat (an unexpected source), somewhat different than the first.

“Fast is slow. Slow is fast.” Watch your fields of fire, pick your targets, aim center mass, squeeze the trigger. The faster you go, the more mistakes you make. The more mistakes you make, the deeper in the shit you will be. Go slow. Try not to make mistakes. Be one with the battle yet transcend it. Float above the action, survey the scene, target immediate threats, and dispatch them with ruthless efficiency.

Basically it says that if things are going very fast, slow it down. Concentrate on the immediate issues and deal with them with ruthless efficiency in a calm and precise nature. Don’t try to do everything at once, you’ll can’t, you will fail.

I can tell you that with my company LandlordMax we have more work than we have resources. There will always be more work than can be accomplished, that’s the nature of the business. Now, we could take the path of trying to do everything fast, but we’d make a lot of mistakes and everything would be probably be done poorly. We simply would not succeed as a business if we did this. Yes, we might get lucky and get a good start, but it would eventually catch up with us. We would make mistakes with time that would bring down our business.

What we do as a business is follow the philosophy of the quote above. We focus on making sure that every feature and benefit we built is done right, we don’t try to add every featuer possible. For example, in version 2.12 we wanted to add many more features, but each new feature that we could have rushed in for the release probably would’ve caused more errors and bugs. Nobody likes to see buggy error prone software, it’s bad for business. We focused on making sure that every feature we added worked, and that it worked well, period. We focused on the most common and important requests, and we’ll continue to do.

As you can see, both of these two quotes are very powerful. Yes it’s debatable whether or not they should be core life and business philosophies, but there’s no debate as to whether or not they can help you succeed.

Permalink to this article Discussions (0)

The Benefits of Constantly Taking Steps Back to Take Steps Forward

I recently came across a really interesting article about Apple Computer folklore. It’s a really good story about one Apple employee who would continually challenge and push himself. At this point everyone will agree that by continually challenging yourself you’ll get better and better, that’s expected. However what’s interesting is that he also pointed out another thing that most people will overlook, each new challenge for that employee will get easier and easier to accomplish.

I recently came across a really interesting article about Apple Computer folklore. It’s a really good story about one Apple employee who would continually challenge and push himself. At this point everyone will agree that by continually challenging yourself you’ll get better and better, that’s expected. However what’s interesting is that he also pointed out another thing that most people will overlook, each new challenge for that employee will get easier and easier to accomplish.

Think of it this way. We have two basketball players. The first player has barely played basketball and the second has been playing for a while (facing many new challenges such as learning to dribble with both hands, shooting three point shots, etc.). Now, let’s say a new challenge appears, something that neither player has ever faced before. Maybe the foul line is pushed back 2 feet, maybe the hoop is heightened by a foot, maybe the size of the hoop has been decreased by a few inches. In any case, it’s easy to see that the professional basketball player will have a lot less difficulties adjusting to these new changes! The idea is that the more challenges you face, the easier each new challenge becomes to conquer!

You could also think of it as driving. When you first learned to drive, every little aspect of driving was a large challenge. Once you’ve been driving for a while, you can learn new aspects of driving at a fraction of the speed as someone who’s just learning to drive.

Let’s think about this some more. Let’s go back to the story about the Apple employee. The story goes that when the employees would get tired they would play an arcade game called Defender (a great game in its day). To quote the author’s description of the game for those of you who aren’t familiar with it: “The goal of Defender is to defend your humans from abduction by aliens. The evil green aliens drop down from the top of the screen and randomly pick up your humans, and try to bring them back up to the top of the screen. You control a ship and have to shoot the aliens, either before they grab a human, or during their rise up to the top of the screen. If an alien makes it to the top with a human, they consume him and become a vicious mutant, which attacks very aggressively. You start the game with ten humans, and if the last one dies, all the aliens become mutants, and they swarm in on your ship from all sides.”

I remember when I used to play Defender myself that I would avoid the mutant aliens at all costs. They would get me faster than anything else! For those of you who didn’t played this video game way back when, it basically meant that your turn was over.

Well the guy in the story decided to try another alternative method of playing the game. He decided to try and take a few steps back in the hopes that he could take a few more steps forward for a positive net gain. He was willing to lose many games temporarily in order to gain the advantage over the long term. And there’s no doubt he did as the story shows.

Well the guy in the story decided to try another alternative method of playing the game. He decided to try and take a few steps back in the hopes that he could take a few more steps forward for a positive net gain. He was willing to lose many games temporarily in order to gain the advantage over the long term. And there’s no doubt he did as the story shows.

What’s interesting though is how he did it. He did the unthinkable. He eliminated all the humans right away! That means that all the aliens became mutant aliens right away! Normally this would be considered insane. However for him it wasn’t. Rather than run away like everyone else and try in vain to hit one or two each pass, hoping you didn’t yourself fall prey to them, he decided to do circles around them. What happened is the mutant aliens ended up clustering together, and rather than fighting a horde of mutant aliens, he only had one large massive target of mutant aliens, or basically one large mutant alien! What an innovative idea.

Of course at first he didn’t do so well because the mutant aliens have special characteristics. They can move faster, travel differently, etc. They very adept at what they do. But after several games, he started to get better and better and would consistently win against his co-workers.

At this point most people will think that trying new innovative ways was the key. Yes it definitely was a key element, he had to be willing to try new innovative techniques and be willing to lose some ground to gain new ground, there’s no doubt. And yes, over time he got better, again no doubt there, practice makes perfect. But what I think is much too overlooked is that from now any new technique he tried would be that much easier to master. After challenging the best the game had to throw at him, any new challenge would be easy. Anyone who could master conquering a horde of mutant aliens could do anything in the game.

The moral of the story of the Apple employee is not to be afraid to push yourself. The more often you push yourself to new challenges, the easier conquering each new challenge gets. The better you get at it. When I first learned how to write computer programs, learning any new technique or language was very difficult. I remember the difficulties I had writing my very first computer program. It was brutal! I also remember how hard it was to learn my second computer programming language. The third was easier, and each new language thereafter got progressively easier. I’ve now learned more languages than I care to remember. But you know what, it’s not the number of computer programming languages that I learned that’s helped me, it’s that now I can easily and comfortably pick up a new computer language with very little effort compared to before. I basically practiced and got good at how to learn new computer programming languages. I practiced and got good at learning how to face new challenges!

Permalink to this article Discussions (2)

Asset Risk Management

Today’s article has been inspired from a book I’m currently reading entitled Fortune’s Formula. Although the book is fairly verbose, it’s worth the read because it does have some very interesting insights and ideas. The main focus of the book is how to manage risk of your assets, regardless of what the asset is. For example, it compares the Kelly System (original paper in pdf format), the Markowitz system, etc. The basic idea is how can you increase your wealth the fastest while minimizing your risk.

Although I’m not yet finished reading it, one chapter really caught my attention. entitled “Shannon’s Demon”. In there the author (William Poundstone) talks about a system devised by Claude Shannon where it appears theoretically possible, and I’ll explain why I say theoretically in a bit, to make profit from the fluctuations of an asset (both when it goes down and up).

The system is very simple and elegant. You start with a certain amount of cash, let’s say $200. You divide this sum equally into cash ($100) and the asset ($100). Then each round (time unit which can be minute, hour, day, month, year, whatever) the asset either doubles or halves. Yes, it can halve and you can still make money! Now at the end of each round you rebalance your portfolio to split the cash and assets 50/50. So for example, if the asset doubles to $200, then you rebalance your wealth ($300 = $200 asset and $100 cash) so that you have $150 in cash and $150 in asset. If it halves, you rebalance it ($150 = $50 asset and $100 cash) so you have $75 in each. You repeat this for as many time steps as you want and you will find that the result is a geometric (i.e. exponential).

In the previous paragraph I allude to the idea that it was theoretically possible. Why did I say this? Because reality doesn’t quite allow for this system to be possible. Firstly, if you were to wait until real estate or stocks doubled and halved it might take a very long time. Therefore this would only be possible with games of change with an even odd of winning and losing. The other aspect is that if you actually went ahead and did this with either real estate or stocks, you’d have to take into consideration fees of buying and selling the assets, not to mention tax considerations. However, ignoring these aspects, it’s a very interesting and thought provoking idea because it really helps to appreciate that it is possible to make money on volatile assets that move up and down.

I took a few minutes tonight to write a simple Java program to test this concept. For you technical people, you can find the source code here and the class file here. The program will output to the screen tab delimited lines which you can use in MS Excel to generate the graphs. In any case, I ran it a number of times with runs of 100 time units with equal probabilities of the asset going up and down. What was very interesting is that no matter what, assuming the asset didn’t go bankrupt, you made exponential revenue. If the asset did go bankrupt, you still made a nice profit up to that point (assuming it didn’t go bankrupt right away and lasted for at least a few up movements). You’ll find 5 of these sample runs below with the wealth graph on the left and the respective asset price graph on the right (the asset always started with a $20 value and the wealth with $100 cash and $100 in assets).

Scenario 1 (Data File)

Scenario 2 (Data File)

Scenario 3 (Data File)

Scenario 4 (Data File)

Scenario 5 (Data File)

As you can see from every single graph above, no matter how low or high the asset price went, it still seemed to generate a handsome profit. Although I didn’t post any of the graphs where the asset loses all of its value, you can see from some of the examples that even when the asset price is almost completely wiped out the wealth graph is still much higher than the original $200 in wealth. It’s also much higher than if you had just stayed and rode the stock all along!

Of course please don’t think that I’m proposing that getting in and out of the assets is necessarily a good thing, because like I mentionned before, once you start to take into account the transaction costs and capital tax costs, not to mention the amount of time it takes for a normal asset to double and halve, it pretty much makes this model impossible. I still strongly believe in the buy and hold model and therefore this article is more to bring forth some new ideas and ways of thinking about assets and risk management.

Permalink to this article Discussions (3)

Why do Real Estate Investors Not Invest in Stocks the Same Way They do in Real Estate?

Although it’s a discussion I’ve had a number of times before in the past, this weekend it re-occurred again. Although not directly in the context of investing in real estate, the concepts are the same. Basically, I’ve seen this happen over and over again, people who invest wisely in other assets (business, real estate, etc.), don’t always use the same principles when investing in stocks. I don’t know how the last people I had this last discussion with invest (we didn’t discuss those details), but the discussion did come up which prompted today’s article.

Often I see many wise real estate investors, wise business owners, and so on, look at the whole of their related investment, do their due diligent, and then only invest in income generating ventures. However these same people will then often completely ignore the same investing principles when dealing with other assets such as stocks! How? Why? I don’t know. If you look at a buying an investment real estate property, you will look at its total cost, at its cash flow, etc. When looking at a stock, you should do the exact same thing. Same concepts, same principles, same research. However the reality is that most people don’t.

In this article we’ll go over how and why you should look at stocks the same way as buying other assets such as investment real estate, businesses, etc.

Let’s start by looking at a basic deal. When you purchase an investment real estate property, you’ll want to look at the total price of ownership to decide if the property is expensive. That is, you want to know what the property is selling at. If you buy a business, say a Subway franchise down the street, you also want to know how much it’s going to cost you to invest in it.

When people buy stocks, more often than not, they want to know the stock price. Then based on this stock price they’ll determine if the stock is expensive or cheap. That doesn’t work! Think about it this way, stocks are only partial ownership of the company you buy stocks in. If you buy a share of Microsoft at $10/share or $40/share, you don’t own the price of the whole company, so how do you know if that’s expensive? If I sold you part of a real estate property for $10 or $40, how do you know which is worth more? You DON’T! You can’t with just that information. Why? Because how do you how big a piece of the pie that share is worth? What if for the $10 a share of the real estate property I sold you there are 1,000,000 shares? That makes the property cost $10,000,000. Now what if I told you the $40 a share real estate property only had 10,000 shares, making that property cost a total of 400,000! That’s a drastic difference! That’s the reality of stocks. That’s why many people fail at investing in stocks. If someone doesn’t even know the total cost of ownership, then how can they be investing? That’s gambling. If I bought an investment real estate property without knowing how much it truly costs, then how could I be expected to make a profit? I couldn’t! Whether or not I did would just be luck.

It’s very easy to get the total price of any publicly listed company, that’s what called the market cap. The formula is as simple as I stated above, the total number of shares multiplied by the cost of each share. This number of course changes daily, because stock prices change, but in any given instance you can quickly determine the total price of a company. Because it changes, don’t expect to be 100% accurate, just use it as a ballpark figure. Like in our example above, we can quickly have an idea of what’s what without needing to know it’s precisely $40,192 versus $40,000 compared to precisely $10,234,725 versus $10,000,000.

Now that we know how to calculate the total cost of ownership, then the next thing that should come to your mind is what is its true value? One theory, the efficient market theory, states that the market always accurately reflects the true value in the stock price. That is to say, the stock is worth what its selling for because everyone has all the information now and can correctly evaluate it. The reality is that it’s not efficient! Stocks are bought by many people, many who know what they’re doing, and many who don’t. Stocks are bought on gambles, stocks are bought on information, stocks are bought on name recognition, stocks are bought on tips, stocks are bought on emotions, stocks are bought for almost every reason.

What this means is that the actual value of a stock is not necessarily what it’s selling for, just like real estate, just like businesses. However the good news with stocks is that the discrepancies can be much larger than they will ever be for real estate properties. For example, if you look at the dot com boom and bust, the discrepancies were incredible! At other times, in a down market, prices can also be much below their true value. It’s possible to buy stocks for much less than they are worth, just as it’s possible to buy real estate much below its true value. The difference is that with stocks, because they are so easy to buy and sell as well as having a low barrier to entry, these fluctuations can be much bigger and faster.

Now that we know that the real value of a publicly traded company and its stocks are not always the same, how do we determine its true value? This is where it gets a little more complicated. There is a lot of debate here. You can talk about trends, you can talk about potential, deals coming up, patents, etc. That’s all fine, but for the scope of this article, we’ll only focus on hard nosed financial facts and figures. How much equity does the company really have? The first place to look is the balance sheet (which is available through SEC fillings and many online sites such as Yahoo Finance).

For our example, we’ll use a really well established company like Microsoft through the Yahoo Finance website. Generally balance sheets are divided into two sections, assets and liabilities. This is just like any investment real estate property or business. In assets section you want to know the hard values of the items you’re purchasing. For a publicly traded company, the easiest hard asset is cash. What’s the cash balance? For Microsoft in June 2005 it is $37.75 billion. That is, if the company went bankrupt tomorrow, assuming no debt, they could give out $37.75 billion to all the shareholders ($3.52/share).

What other hard assets can a company have? Many. It can own factories, inventory, etc. The only issue I have with this is that if the company went bankrupt tomorrow, you might not be able to sell these assets at full value. Therefore you should recalculate the balance sheet to reduce the assets at a discounted value. How much? That depends on the industry and how much security you wish to pad your price with. I like to be conservative myself, so I really low ball these assets.

One word of warning when calculating other assets, there are two rows you need to be extremely careful of, they are intangibles and goodwill. Without going into too many details, these are items that have no real hard assets behind them, that is if the company disappeared tomorrow, that value wouldn’t be paid out in cash to you. Examples can include the value of a brand name. How much is the name brand “Coke” worth? “Microsoft”? That is how much people buy their products because they know the name. The answer is that it depends. It’s worth something, but how much can’t really be determined.

Another item that’s often added here is the premium paid when a company acquires another. For example, if a company acquires another that was going for $1,000,000 but they paid $1,250,000, then you would add $250,000 as goodwill. This is the premium paid to acquire a company (which is very common). Therefore to be safe I completely discount these two rows because to me they have no really definable value that I can easily equate. This is just like how much is it worth to have beach front property? It’s definitely worth something but how much exactly I don’t know, there are just too many variables to be anywhere near accurate. Therefore to be safe I don’t assign any values to it and therefore I’m excited when I find a beach front property that has a balance sheet exactly as one that isn’t beach front!

The second section is debt. Debt can be your friend, but in business it’s a liability. These are payments you need to make every month. You need to verify that the company you are buying is not overloaded with debt. This is the same as verifying that you yourself are not overloaded with debt when purchasing a real estate investment property or a small business. You need to verify that the company can service its debt otherwise it will go bankrupt. What’s too much, well that depends again. Each industry is different and each business is different. I personally like to play it safe and avoid companies that have more than 25% of their cash reserves in debt. I understand this is stringent, but I don’t like to lose! No debt is even better when it comes to acquiring a business. Imagine if you could buy two real estate investment properties for the same amount of money, but one would require you to be in debt while another wouldn’t. Which is better?

Another thing to avoid is companies that grow through solely through debt. You can grow through debt, but eventually a company will cap out. Think of it this way, if the only way you could grow your real estate portfolio is 100% through financing (not from re-investing profits from your current properties), then eventually you will get crushed by a downturn in the market or by a lack of acquire future funding. You want some margin for safety. If I went out and bought every rental property I could with 100% financing, at some point I would get crushed. I might last a while, but if interest rates climb by even a small rate, or if one of my properties has some problems for even a short time, I’m at risk of collapsing my entire portfolio. The same is true for companies.

Now that we quickly looked at the balance sheet, what about the cash flow statement? When you buy an investment real estate rental property, you should definitely look at cash flow. Is the company consistently generating positive cash flow? Would you buy a real estate rental property that’s generating negative cash flow (assuming you couldn’t do anything to fix it yourself because you can’t personally manage a publicly traded company either)? I wouldn’t. So why is this important aspect so often ignored? I wish I knew… However, the reality is that it is often completely overlooked.

Looking at a publicly traded company’s cash flow statement is almost the same as looking at real estate property’s cash flow statement. For example, if we look at Microsoft’s, we can quickly see their yearly cash flow is positive with the exception of this year (2005), which was highly negative in comparison. In this particular case, rather than completely dismiss the company without looking further, we can quickly see on the cash flow statement that the reason it had such a negative amount is that it paid a one time dividend of $36 billion dollars! There’s no way the cash flow cannot be affected by such a large dividend. However, on a normal basis, what we’re looking for is a consistent positive cash flow, just like a real estate rental property. Sometimes you’ll get the odd inconsistency, however overall you want positive consistency.

There are many other aspects of publicly traded companies that are almost identical to real estate rental properties (and commercial properties). However for the scope of this article we’ll stop here today. The idea is that if you take the same amount of time and pay the same amount of attention to your real estate rental properties as you do to purchasing stocks, you’ll probably come out ahead. If you don’t, then you probably should look at buy index funds because they basically mimic the market average. You will never beat it, but you will also never lose to it. For the astute investor who has the time and is willing to put in the effort, the rewards can be very positive, I can assure you from personal experience.

Before I end this article, just a couple of other quick tips for you when purchasing stocks. Firstly, pay careful attention to ROE (Return On Equity), it’s one of the metrics I use myself very religiously. This metric is basically supposed to measure the return on the value of the equity. So if you have an ROE of 15%, then the true business value (the value of the assets of the company) as suppose to increase by 15% for the year. Please note that you should calculate this value yourself, after you’ve made the adjustments we talked about above. For example, a company can say that its brand value is increasing by 50% a year while its real hard assets are actually decreasing by 35% in value each year, giving it an ROE of 15%. This could give you a nice looking positive ROE where in reality it’s very negative. I’ve seen this very legal trick played much too often.

The other tip is to avoid company’s that inconsistently take huge financial hits in down markets. Without naming names here, there are several companies over the last 2-3 years that have taken large losses, larger than they acquired in any one year. You can do this for many reasons, for adjustments, right-offs, etc. However some companies use this to absorb all their losses during a down market, when their stock price is already depressed. This way they can absorb losses for many years at one time while the stock is already low, after all it can only go so low. Then when the market picks back up, their profits are back, because the losses they should have claimed for that year are all used in that one bad year. This way they can have one extremely bad year and maybe 5 or so good years. However, if you average the company over say 7 years, then the rosy picture of the 5 good years no longer look so good. This is the same as someone who inflates their real estate rental income just before they sell. For example, they can pay all the regular expenses a year or two beforehand by buying all their supplies and stock piling them in anticipation, making the property look cheaper. The can also keep their entire inventory loss (renovations, etc.) and write it all off as one massive loss in one single year. There are many tricks that can be used to inflate the real price that can be used for any investment asset, including real estate and business. Real investors can generally see these, or at least have lots of red flags firing off left and right when they encounter them. I personally don’t believe in these tactics, but I do need to be aware of them to properly and correctly valuation all of my investment assets.

Lastly, if you are interested in buying stocks, then there are definitely some books I think you should at least read. If you’re only going to read one book, then I would suggest the The Intelligent Investor: The Definitive Book On Value Investing, Revised Edition by Benjamin Graham. It’s not a complete book on stock investing, there are more enhanced ways of valuating companies, but it’s a great start at understanding the fundamentals. After all, he’s the one who thought Warren Buffett how to invest in stocks. In any case, please find below a quick list I compiled of some of the books I found very informative (in no particular order):

The Intelligent Investor: The Definitive Book On Value Investing, Revised Edition

The Warren Buffett Way, Second Edition

The Essays of Warren Buffett : Lessons for Corporate America

Security Analysis: The Classic 1940 Edition

Reminiscences of a Stock Operator (A Marketplace Book)

When Genius Failed : The Rise and Fall of Long-Term Capital Management

Take On the Street: What Wall Street and Corporate America Don’t Want You to Know

Buffett : The Making of an American Capitalist

How to Lie With Statistics

Permalink to this article Discussions (0)

Can You Save Your Way to a $1,000,000 Dollars?

I recently had a discussion with a friend of mine on whether or not it’s possible to save your way to a million dollars or if it’s only possible to earn it. We talked about it from many angles, and yes it’s possible, but it’s very unlikely. You’ll have to live very cheaply for a long time, at least more much more cheaply than I care to.

So how did we come up with this finding? Like most of the other articles on this blog, I worked out the numbers. Today’s article is all about the numbers we worked out during that discussion. We’ll start from one angle and then work the what-if’s, how-to’s, and what-about’s after.

Ok, let’s start with a basic premise, let’s start with a salary. Where do we start here? To make things simple, let’s take the median Californian’s household salary of about $54k. Let’s assume a 25% tax rate straight off the top (which is probably lower than the actual rate, therefore working in our favor), leaving us with $40.5k in net income. Now, according to “The Wealthy Barber”, we should invest 10% of our income. Again to pad it in our favor, let’s make that 10% of gross (pre-tax income) rather than the net income. This means we will put away $5.400 a year into an investment instead of $4,050. As for the interest rate, let’s take an easy to measure interest rate, the current 30-year fixed US Treasuries rate of 5.375%/year. After 30 years, you would have $391,792.50 in your account. You’d be short about 61% of your goal of a million dollars!

Alright, now that we have a baseline, let’s start looking at these numbers in more detail, let’s change them, and let’s work with different assumptions. Ok, first, what if instead of 10% we saved 20%? What difference would that make? $783,585.05. Much closer but still over 21% short of our one million dollar goal. To make our goal of one million dollars we would need to put away $13,782.81 each year! Assuming a median income of $54k, that represents over 25% of gross income, or over 34% of net income! In other words, for ever dollar you take home after taxes, you need to put 34 cents into your investments, you need to live off of just under $27k a year. In California, assuming the rent is at least $1k a month (which is low), that means you need to live on $15k a year for everything (car, food, health, kids, entertainment, travel, etc.) for 30 years! That’s not very much, not much at all.

Ok, let’s look at it from another angle. What if we increased the interest rate to a more aggressive interest rate? Let’s take the average compound rate of return on stocks from 1802 through 1991, 7.7% per year. Assuming this rate of return with our original 10% of gross, would we make our one million dollars in 30 years? Unfortunately no, we would have made only $609,226.29, still shy over 39% of our targeted one million dollars. At that rate of return, we would need to invest $8,863.71/year, over 16% of our gross or almost 22% of our net. Although possible, I personally think that consistently investing 20% or more of the net income of the median family is probably asking for too much for the ordinary person. Investing 20% of 100k net in revenue is possible, but not for the median income family, it’s just too much.

Ok, so let’s look at it this way, assuming we want to save only 10% of our net income, the smaller of the two numbers, at the higher rate of 7.7%, then how much income would we need to produce? $88,637.11 in net income. Assuming a tax bracket of 25% again (it’s probably higher as taxes get progressively higher with additional income), then we would need to make $118,182.81 in gross yearly revenue!

The next question that comes to my mind is what interest rate would you need to earn on the median salary to have 1 million dollars after 30 years, assuming you’re putting away 10% of the net income of the median household income of $54k? You would need to earn consistently over 30 years 10.139% compounded interest a year. This is very doable, however it tells me that I most likely need to be a smart equity investor, a smart real estate investor, or start my own business. Chances are that I won’t attain my 1 million dollar mark (in today’s dollars) otherwise.

Now I can already see some of you saying that with inflation, one million dollars isn’t going to be anything in 30 years. Very true, but remember these calculations are in today’s dollars. That is, what you have in the bank (or in investments) then will buy the same amount of stuff then as it does today if you had a million dollars today. In actually, if you add inflation into the calculations, these numbers look even worse because you now have to reduce your real interest rate by 3.5% (today’s inflation rate). So if you make 7.7%, you’re actually only making 4.2%!

I can also suspect some of you will comment about increasing your income, and hence contributions, over time. Yes, that’s all true and all, and I completely agree. The thinking is that although you might not make over $100k today, you will tomorow so you should be able to play catch up by putting away bigger and bigger amounts. Yes, this is true, sort of except that there’s a catch! This is where the power of compound interest becomes very very interesting! Again, nothing speaks as well as working out the numbers, so let’s do just that.

Say I invest 10k in year 1 and do nothing for 10 years at 7.7%. I will end up with $100,003.52 after 30 years. Now, what if I invest $1k every year for 30 years (i.e. I invest for a total of $30k)? I will end up with only $112,819.69, a difference of about 10%! Wow! I invested 3 times as much money only to make 10% more! Catching up really didn’t help much.

Of course, in the example above we spread it out over 30 years. What if we do the same numbers, but over 10 years now? Get ready for a shock! For the initial $10k investment in the first year and nothing after I end up with $21,544.60. If I do the second scenario, investing $1.5k a year for 10 years, I end up with $21,706.79. I actually have to invest 50% more money to get the same final balance.

Let’s look at the effects of compound with one last example. Let’s say I have no money initially, so I invest nothing for 10 years. Then for the next 10 years I invest $2k a year, then for next 10 years after that I invest $3k a year, what will I end up with? $105,768.77! Wow! I end up with almost the exact same as if I invested $10k the first year. I have to invest a total of $50k to catch up to my initial $10k investment. 5 times as much money to end up with about the same final amount! That’s the power of compound interest!

You can play with the numbers, but you’ll find that as interest rates climb, the differences become even more staggering. Basically the idea is that you should let time be your friend. The longer you can compound a number the higher the return. Remember, compound interest is an exponential formula, so use its power to your advantage. Put as much as you can early on, it’ll make a world of difference tomorrow because its very costly to catch up later. Therefore using the argument that you’ll be making more money later and hence bigger investments is probably not a good one.

All in all, it’s possible to save a million dollars but the odds need to be in your favor. The math above assumes historical averages with median salaries. The math here does not deal with factors such as unemployment losses (you’ll probably have some bad months in your life, etc. The numbers also doesn’t deal with inflation which could substantially affect the results. Also, since these calculations don’t consider inflation, they assume that you’re gaining the full stock return which is completely untrue! For example, if you’re stocks went up say 10% this year, then you only really made 6.5% after adjustments for inflation. That’s right, you need to remove 3.5% for inflation. So for example if you had $100 invested and you made $10 for a total of $110, then you’re $110 can only buy $107 of equivalent goods as compared to your $100. As a more concrete example, if you could buy gold at $1/lbs, then in year one you could buy 100 lbs of gold. In year two gold would have gone up to $1.035/lbs because of inflation (assuming a 3.5% inflation rate), allowing you to buy only 107 lbs and not 110 lbs. This means that in reality our calculations are better than reality because we didn’t take this inflation into consideration.

Also, these calculations assume you never pay taxes on your investments. If you do pay capital appreciation taxes then the numbers change drastically. Therefore, a quick tip for this type of investing, try to pick investment vehicles that you can stay with for a longer term to avoid taxes because they can have drastic differences in these calculations as seen in my previous article on the affect of taxes on the real estate investment returns.

Now that you know most of the math what do you think? I personally don’t think it’s feasible to assume most people will be able to save and invest $1,000,000 dollars in 30 years. Not that it’s impossible, people have done it, but I don’t know that I want to live that type of financially squeezed lifestyle. Rather I think you’ll have to look at other avenues to increase your revenues (or rate of return) rather than just try to save your way to $1,000,000. You should probably look into investing wisely in equities, real estate, or building your own business. Basically, you need to look at something other than just putting money away in your mattress, because the honest truth is that in 30 years you’ll likely not have the $1,000,000 you worked so hard to save for, you’ll only have a fraction of that. I’m not saying don’t invest, I would never say that, actually I’m a very strong proponent of investing. All I’m saying is that you probably need more than just plain saving in your financial plan to get your $1,000,000.

Permalink to this article Discussions (22)

| « PREVIOUS PAGE |