LandlordMax – New Bank Reconciliation Feature

I’m proud to announce that we’ve added bank reconciliation to LandlordMax. This feature allows our users to reconcile their accounting entries with their bank statements and accounts. You can find the short and fast video tutorial here as well as the full length tutorial video here. You can also find the user manual page here as well as our company blog post about it here.

I won’t got into the details of how it all works here, for that I’ll refer you to the above links. Instead I’m more going to focus on the design and implementations aspects of this feature, the behind the scenes perspective if you will.

This feature is quite interesting because what seems obvious and intuitive at first is absolutely not obvious or intuitive, at least not until you start to get into the weeds of implementing it. Some parts were pretty simple but one part especially wasn’t.

Firstly, and before going into any details, one thing to remember is that this had to be an optional feature, that is some people will use it very heavily while others may not use it at all. For this feature that wasn’t too too challenging, entries by default are set to unreconciled, and if you never reconcile them then they just remain unreconciled. You can then ignore the bank reconciliation reports, and you can even go as far as hiding that field from the table and what have you.

Our main focus was then on making the whole process of reconciling entries as easy, quick, and streamlined, with as few clicks as possible. In essence those who are going to use the feature will be using it a lot, and they want to be able to reconcile their accounting entries very quickly. They also don’t want anything overly complicated, requiring a ton of clicks and settings. And that’s where things got challenging very quickly. Making something easy and efficient takes a lot more work than most people realize. It’s like how a professional athlete makes it look easy to play a sport, sometimes it looks like they’re barely even trying, but behind the scenes we forget the thousands of hours they spent practicing and honing their skills, all that’s involved in making the actual movement look so smooth and effortless. To push this example a bit further with a more concrete example we often forget how hard it is to drive until we see someone start to learn how to drive.

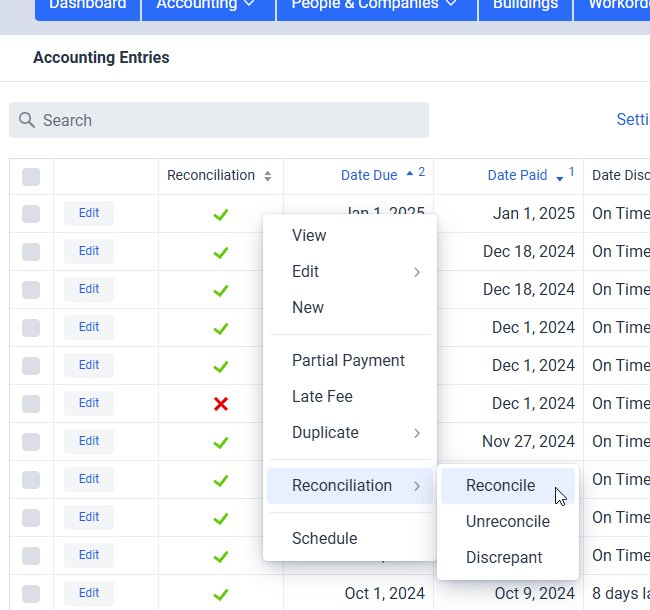

And so in that vein implementing an easy and streamline process was not obvious and took a lot of effort. I’ll also preface it by saying that even things like having multiple options on how to reconcile entries took a lot of thinking and testing, and re-tweaking and adjusting. We think we’ve done a good job, especially that our users can do it so quickly with a minimal amount of clicks and effort. Select the entries in the table, right click on the entry, and pick the reconciliation status right there. If only it were that simple and that covered all the user cases, but the story doesn’t end there by any means.

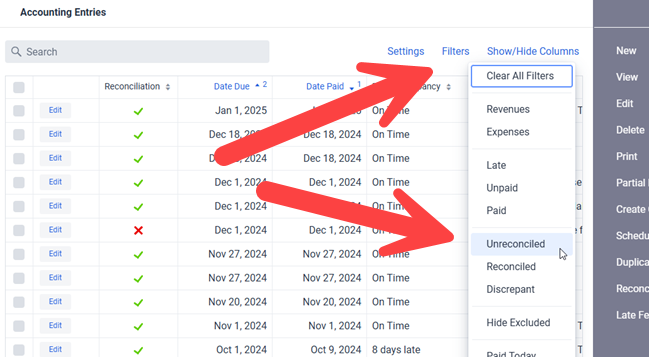

Imagine someone has thousands of entries, that can make finding a particular entry a bit more challenging. Sure they can sort the entries by date, and by default they are sorted to keep the most recent entries at the top, but what if they have multiple bank accounts to reconcile or other similar scenarios? This is where things like data filters are especially useful. For example they can let the user limit the accounting entries to just unreconciled entries, greatly shrinking the list of entries on the screen. That means if they say have two bank statements, and they’ve already reconciled one statement, that they’ll then only see the entries from one bank statement (the unreconciled one). But it doesn’t end there, they can expand further by adding additional filters. They can also use the search in combination with the data filters so that the search only applies to unreconciled entries and can get very fined tuned if they prefer that approach, or the entry isn’t immediately jumping out at them on the screen. This way people with just one bank account to reconcile as well as those with multiple accounts can quickly reconcile their statements. And that’s just one example of the different types of scenarios we wanted to make sure we covered.

In other words, whatever the situation our users need to be able to quickly and efficiently find the entries they want to reconcile. They don’t want to be spending hours reconciling, if that was the case then the feature wouldn’t be very useful. And keep mind so far we’re just talking about reconciling entries which is the simplest case, we also need the ability to quickly deal with discrepant entries which includes editing the entry to add notes and so on. There’s functionality for all this and more. On a related note we also want to keep supporting the different ways people perform similar actions depending on their preference rather than forcing them to use just the one and only method we deem as the best.

The biggest and hardest challenge by far though was whether or not bank statements should be imported. That is a very big and very deep rabbit hole, and I’ll only touch the surface of it here today, but hopefully it will be enough to give you an appreciation of why we went in the direction we did.

The biggest issue with importing bank statements is that a bank statement is very limited in information. Specifically it only really contains the date and amount, and sure there is some payee information but it’s generally very limited and often coded. That and not each bank will display the payee names the same way. For example a Home Depot transaction could be “Home Depot”, or it could be “HD”, or something else. It could also change over time. And in some cases it may not even include the payee if it’s a bank transfer, or even worse, if it’s a cash deposit or something along those lines. And again if they have more than one bank statement each bank could have slightly different name for the same payee. Sometimes they will also attach location to the payee such as the address of the specific Home Depot. Meaning if they’re looking for say “HD” that could match with other payees with those letters in the name (“hd” is less common but imagine a more common abbreviation like “ne” or something like that). In essence they need some kind of mapping between the names and payee, and this has to be done for all their tenants, vendors, and so on. And that mapping could be a table of names for tenant, vendor, etc., for example multiple Home Depot locations.

Another big challenge is that bank statements do not include things such as what category type the transaction is for. For example is the transaction a rent? The bank doesn’t know or care. It’s just a transaction. For what building/unit was the rent payment made towards? For which building/unit was the toilet from Home Depot for? The bank statement has no idea. Was the rent paid on time? When was the rent due (the Date Due field in the software)? What about a description of the entry? The bank statement has no idea when a rent was due, just when it was paid. If the user imports a bank statement it doesn’t have any information on when the rents were due, if they are late, and so on. What about if someone pays cash? How does it know which transaction is for which rent based on a cash deposit? What if several rents were deposited together as one cash deposit? You would then have to have some way to split up that imported accounting entry. But how? What would that screen look like? What if it’s a tenant paying two rents at the same time combined with another tenant paying a rent? Do you show a table of accounting entries to select from and start to break it down? Again how does all that look like on the screen? Tables of tables? And what about all the information such as marking it as a rent payment rather than a toilet repair, when the rent was due, for which unit, and so on. The user would have to do a ton of data entry on top of some very complicated screen. That would be awful.

And it doesn’t end there, it just gets worse and more complicated. Just to add one more example, what happens if they decided to import a bank statement halfway through a month and then decided to re-import it again a week later, maybe with the new extra week of transactions included with the previous few weeks of transactions? What about the entries already imported? How do you confirm that entries from a previously imported statement aren’t the same? All that information also need to be stored in the software, including that an entry couldn’t been split over multiple entries. You would also need screens to be able to show that later if you’re trying to decipher what happened during your year end. The amount of screens and their complexity, not to mention all the extra work you’d have to do, gets quite large very quickly.

This kind of functionality is called merge/synchronize capabilities in software, and these can get quite unwieldy very quickly. So much that in the programming world there are software applications dedicated solely to perform these kinds of operations. As in the software whole job is just to merge code as you update it. The most famous these days is Git, and it’s quite a beast to master. I especially love this comic from XKCD about git where the end line to the question on how it’s used is: “No idea. Just memorize these shell commands and type them up to synch up. If you get errors, save your work elsewhere, delete the project, and download a fresh copy.” All that to say it is possible, and for bank transactions it will be simpler than with programming code, but even then it’s still not something that’s simple. The screens to be able to do this would add a lot of complexity to the software. You would not only need tables of the transactions on each side for those that don’t match and somehow the user would need to be able to match one with the other. Don’t forget you’d also need to confirm the matches to be safe.

Meaning even if a user were to import the bank statement, and let’s say they were lucky and matching up transactions from the bank statement wasn’t too crazy, they’d still have to go into every entry and add all the missing information manually which is a ton of work and effort, way way way way way (and yes that’s a lot of way’s) than how it’s done today which is just a click to reconcile combined with scheduled accounting entries. By using scheduled entries for rents, as well as any other recurring transaction (including expenses), then all this data entry is automatically done for them. This leaves them only with the quick and easy task of just checking the entry to reconcile and they’re done. Everything, all the information, is there for them all the time, and all it takes is a click quick to complete the reconciliation. It’s many many many (again lots of many’s) easier and very quick.

And I just touched the surface of the rabbit’s hole, it gets a lot more involved the more you get into it. Don’t get me wrong it’s possible, but it would be a whole other level of complexity and effort for our users. This by the way is also why we only see it in very expensive (and also very complex) software in our marketspace. There’s no easy and efficient way to do. Our goal is to streamline our users operations, and as you can see we believe this is much much much (yes again many much’s) more efficient and user friendly. We believe it is much better to spend a handful of minutes marking entries as reconciled than having to spend hours to manage the import and/or merge entries from a bank statement, as well as manually having to add in all the extra information that isn’t even available in the bank statement. We did look at a lot of options, and tried and tested quite a few, but we always came back to this same conclusion.

Reporting however was pretty straight forward. The main challenge here was trying to balance what our users would need and use. This lead to about 25 bank reconciliation related reports. They can of course create their own custom versions of the reconciliation reports but the provided ones should be more than ample for the vast majority of people. And as always it’s very straight forward to run the reports.

All in all this feature turned out to be a lot more involved then we initially expected. First there was a lot of time and effort, and especially a lot of working through different options and testing them to different degrees. There was a lot of testing and tweaking on the usability of processing the reconciliation status to make them so streamlined. The most challenging part was whether or not to import the transactions or rely on the scheduled accounting entries, and after a lot of deliberations and testing, we believe that using the scheduled accounting entries is the best option by a very large margin. You get all the same results with a fraction of the effort and complexity. Overall we’re very happy with how the feature turned out. It was a lot of work and it’s now available in the software. And now that it’s released, we can focus on the next features we want to add to the software!

Permalink to this article Discussions (1)

Mortgage Affordability – 2005 Revisited

About 17 years ago (back in 2005) when mortgage interest rates were around 6% I posted an article called How interest rates can drastically affect real estate prices. At the time I was already amazed by the low interest rates and was concerned they would go up and how it would affect people. It’s finally started to hitting us, and what’s even more challenging is that the percentage increases per 1% is higher than it was in 2005 because interests are so much lower today than back then. In other words going from 6% to 7% is an increase in monthly payment of about 10% whereas going from 3% to 4% is an increase of between 13% and 14%. In fact at the time I hadn’t even calculated below 4% because I never thought it would go that low because that was below the historical inflation rate. We definitely live in different times.

In the last few months we’ve just gone from 3% to about 6%. I’m going to use 30 year fixed interest rate because it’s a lot easier as I can just use the FRED data. In any case that’s a 3% increase in a matter of months. That’s also double the interest rate! Looking at the chart from my previous article about how interest rates affect real estate prices, someone who could afford a $1000/mth mortgage back in the summer of this year could afford up to about $235k mortgage whereas today that translates into a $167k mortgage. That’s a huge drop of about almost 29% affordability. If you look at the median house price across the US of $429k (as of early 2022) then that means a drop of $124k, or a drop from $429k to about $305k. That’s very significant.

That was at the time while the market was hot and people were buying. What happens today when people are struggling financially and buying is much much lower? Where you just can’t flip your house or refinance on a higher valuation? If you look on Reddit there are a lot of stories of people on variable interest rates seeing large increases in their monthly mortgage payments. We’re talking multiple hundreds a month to over a thousand dollars more per month. That hurts.

Let’s do the reverse and let’s calculate the difference in monthly payments on a mortgage that was previously paying $1000/mth at 3% interest. We’re still going to use the 30 year fixed mortgage but the math still applies to variable rate mortgages as well as people who need to refinance. That being said a $1000/mth mortgage at 3% affords you a mortgage amount of about $235k. If we take that same $235k and apply a 6% interest rate then the payments balloon to a little over $1400/mth a month for a 40% increase in your monthly payments.

If we extrapolate that to the median house price (assuming 0% down to make the math easier) then that means a mortgage of $429k with a monthly payment of a little over $1800/mth. Today that has now exploded to $2572/mth for an increase of $772/mth. That’s very significant for the vast majority of people. That’s an increase of almost 43%! It’s not just the percentage but the absolute amount of $772/mth is by itself very significant considering the annual median household in the United States is $70,784 (as of 2021). That’s an increase of over 10% of their salary going to their mortgage. And that’s before taxes! If you do the math after taxes it’s probably 15-20% and higher. Ignoring that the median income generally cannot afford the median house, but if it could then the math would be even more challenging.

And we haven’t even started to touch on the topic of those mortgages which keep the monthly payments the same but add on the difference in payments to the mortgage amount. Meaning that if your monthly payment was suppose to go from $1000/mth to say $1400/mth than that $400/mth difference just gets tacked onto the principal amount. Meaning each month your principal is very likely increasing. For a median house that’s an additional $772/mth increase to the mortgage. It won’t be exactly that because of the details but it’s quite significant nonetheless. In other words they would be getting more and more into debt. What happens when they refinance when the mortgage term is up?

And that’s the key. The fallout will take some time to happen. There’s a lot of complexity and variables but there will be a correction, the question is more of when exactly. The first question is what is the average term of mortgages these days. In other words when are most people due to refinance? Until it comes time to refinance a decent amount of people will be able to muddle through. Not everyone but a lot. But once refinancing hits that’s where it will be very challenging for a lot of people. Especially if interest rates continue to climb as is expected to fight inflation. Yes we’ve pushed back inflation a little bit but I don’t believe that battle is anywhere near over. The other question is how many are on variable rates that can continue to holdout.

In addition as interest rates climb prices of houses have to fall. Prices were so high because affordability was so high because of the historically low interest rates. Aka free money. But in turn when interests go back up that also means house prices will have to drop which in turn means for a lot of people their equity will be decreasing. Instead of refinancing to take out equity of their property they will have to put in balloon payments if they end up being underwater. Can they afford that difference?

The other question is will inflation continue to be higher than interest rates because if it does then that could help out a lot people. So for example if inflation were to be at 10% (an even number) then assuming you had a 10% raise and the interest rate on your mortgage remained at the current 6% then you would actually be ahead. That mortgage would be worth less in 2022 dollars. As a more extreme analogy imagine a $30k mortgage for a house in 1980. $30k today is a much smaller amount then it was in 1980 and would be much more manageable then the median $429k. Of course it won’t be as extreme but when inflation is higher then interest rates it can be challenging. Even more so if salaries rise with inflation, which unfortunately doesn’t seem to be the case right now. Nonetheless inflation is having an impact on mortgage affordability.

Seeing as the goal of the Fed is to keep inflation rates in check I believe they will have no choice but to continue raising interest rates until inflation starts to go down, at least in the short term. At the very least keeping it higher then we’ve been used to for many years until inflation starts to get more reasonable. And that’s relative, even today’s “high” interest rates should be considered historically low interest rates. Pre-2000 interest rates were pretty much always above the current rate of 6%. The real question is how will this all play out in terms of interest rates and inflation as they both have very big impacts on loans and mortgages. The speed and scale at which they are moving doesn’t give the markets the chance to easily absorb the changes. This is leading to a lot of chaos and distress right now.

On a positive note there will be a lot of buying opportunities in the near future for those who position themselves well. Even with all the doom and gloom, or in fact because of the doom and gloom, there will be some great opportunities. As the saying goes, fortunes are made and lost in times of chaos, and we are clearly heading in such a time. Not that 2020-2022 were easy times, I just suspect that 2023 will be more interesting in terms of the impacts interest rates and inflation will have on the markets (financial and real estate). We’re about to see the true costs of all the recent money printing and the long term low interest rates. The can was kicked down the road but we’re now getting near the end of the road and can’t really keep kicking it much further without risking high inflation which is a much bigger and worse problem. Some even speculate a once in a generation market crash, a super cycle if you will. Whatever happens the thing to remember is that when there is chaos there is always good opportunities for both failures and much much more importantly successes. May you be one of the successful stories of 2023!

Permalink to this article Discussions (0)

Amazing Tip To Increase Your Real Estate Rental Profits in Less Than a Day

Before I begin let me share a story that some of you might have already hear, at least in some variation of another. A woman sends her husband to the store to buy a ham, but she specifically asks him to have the butcher cut it in half. Of course the husband forgets to ask the butcher, so when he gets home his wife is not too happy that she has to cut the ham in half. The husband then proceeds to ask his wife why she cuts it in half, to which she responds that her mother has always done it that way and that was reason enough for her.

Luckily for the husband, his mother-in-law is there visiting for Xmas. So he takes the opportunity to ask her why she always cut the ham in half before cooking it, to which she replies because that’s how her mother also always did it.

Still not happy with this answer the husband convinces his wife to call her grandmother to try and figure out this mystery. After all, this is now three generations that have always cut their hams in half before cooking it, and no one knows why. It baffles him that no one has ever asked why. Well thankfully the grandmother finally had the answer, it was because her oven was too small to cook a ham in one piece, so she had to cut it to make it fit. A simple solution to a simple problem that was no longer true.

The moral of the story of course being that everyone just did the same thing because that’s how it had always been done. No one ever questioned WHY it was done that way, they just went ahead and continued to do the same thing.

And this is at the heart of the incredible tip I’m going to offer you today on how to increase your PROFITS, not your income, but your profits, by a pretty significant amount!

As many of you already know, my company LandlordMax Software sells property management software (also sometimes refered to as rental property software, landlord software, and so on). One questions we get asked often enough is if we offer check printing. Which leads right into the tip on how to significantly increase your profits while at the same time reduce your workload!!

Why do people need check printing? Seriously. Think about? Why? Do you really need to have software that prints out tons of checks each month these days? When is the last time you looked at automating their bill payments? Most property managers and landlords just continue to write and send checks for their bills, but why? Because that’s how they’ve always done it. But is it necessary?

Today many many many bills can be completely automated. If you cover the utilities for your tenants as part of the rental agreement, then each payment to the different utility companies can be automated, avoiding the need to write and send a check to each company. We’re not talking just one check here, possibly quite a lot. Today most utility companies have some kind of method or other to have your bills automatically paid.

If you’re a property management company that sends checks out to the individual property owners, there are a number of other options you can exercise. Most banks and financial institutions have all kinds of ways to send money digitally that will save you time and money (and fees). For example most employers these days no longer pay their employees with checks, most just do direct deposit. I’m not suggesting you take their route with your clients, only that there are options out there. When was the last time you looked?

How much of a difference can it make? What is the cost of writing and sending one check? My personal ballpark figure is about $1-$2 per check. This includes the cost to order the checks themselves, then there’s envelopers, stamps, bank fees, etc. I’m also ignoring any penalties for checks lost in the mail, which if you send a lot of checks, you’ll for sure have had some checks lost in the mail.

Above this I’m also not including all the labor costs. Sure the software can automate some of this, but you still need to load your printer with special checks which you probably had to order at a marked up price to match the specific you’re using. Then there’s the time of putting each check into the right envelope, making sure there’s no mistakes along the way. And don’t forget preparing the envelopers and so on. Printing all those mailing labels, sticking them on. It adds up faster than most people realize.

And I haven’t hit the price of the software. If you have a professional property management software solution then you’re easily looking at the thousand dollar or more range. If you’re using a small business accounting software with check printing, then it’s at least some hundreds. If you’re not using any software, then how long does it take you to manually write all those checks? In either situation there is a cost.

With all that in mind, if you have over 100 tenants (an easy round number) at 5 checks a month per tenant on average (plus one property owner payment), you’re looking at spending anywhere from $500-$2000/month of total expenses on just producing checks! Over a year it can easily get into the five figures! I do strongly recommend you look at your own full costs for writing all those checks, don’t just use my numbers. Do your own calculations.

And don’t forget to include the time costs, I can’t imagine an effort like that takes one person less than a full day to accomplish if it was all done at the same time. Over a year that adds up to 2.5 weeks business weeks of full time effort. Yuck. What a waste of time! I don’t know about you, but I have much better things to do. Especially if this can all be automated.

Now imagine that all it took was a day to automate almost all of this effort. No more need to print and/or send checks. Even if you can just automate your regular bills, and for property managers the need to print checks for your clients, how much money and time would you save? And again, this is PURE PROFIT! You’ve just reduced your costs, and not only has it not reduced the quality of your business, you’ve actually increased it!! All this because you’ve finally looked at WHY it’s always been done that way before!

To answer my question about our software, no we currently don’t offer check printing. We would like to, and do plan to eventually offer it (even after all I’ve said). However it’s not normally something you’ll see in competing solutions anywhere our price range. It’s much like a tenant asking for an in-unit hot tub while only paying an affordable rent. You can definitely get an apartment that offers in-unit hot tubs, but you should expect to pay quite a bit in rent. The same is true for check printing. However when people ask us, the answer isn’t really no, it’s more why do you really need check printing? Wouldn’t your time be better invested in researching what you can automate rather than just continuing to do what you’ve always done. Not only will you save on the price of the software, but you’ll save money each and every month from now on! And as an added bonus, the cherry on the whipped cream, you’ll have more time to grow your business rather than spend it on busywork that offers no real and lasting value.

Permalink to this article Discussions (4)

Facebook IS Overpriced

We’re definitely in a tech bubble again. Tech IPO’s are over priced once again. Just last year I wrote the post Groupon – Back to Crazy Company Valuations, in which I explained how and why Groupon was insanely overpriced. What’s happened since that post? They went public, quickly climbed to the $25 mark and then not even a year later they’re barely trading at $12! That’s a 50% price decrease!

Not only that but their numbers still make no sense. Ignoring their accounting oddities and controversies, the P/E alone would be staggering (assuming they had a profit). For the same market cap you could buy quite a few amazing companies with a lot less risk and the same revenue growth.

But today’s article is about Facebook and not Groupon, so let’s look at their story. Why do I believe they are incredibly overpriced? Firstly, the IPO price was insane. $38? Seriously? That gives them a market cap of about $100 billion dollars! In of itself that’s not a big deal, but when you take into account their revenues and then it’s insane!

The P/E for Facebook is over 100! The last time we saw P/E’s like that was in the dot com boom from about a decade ago.

But ignoring that fact, let’s do a comparative analysis of Amazon to Facebook, since they have about the same market cap, are both in IT, and so on. Facebook has $3.7 billion in revenues. Amazon has $51 billion in revenues. Yes that’s more than 10x the revenues. Both are experiencing similar growth rates. Amazon has about 5x the total profits of Facebook. Both are selling for the same price!

So why would I buy a company that’s at least 10x smaller and making 5x less profits for the same price? Or put another way, if you could by a local little store for $100,000 or one for $1,000,000 that had the same revenues, same growth, etc., which would you buy?

Ignoring that, which means ignoring yet another red flag (which in of itself should be yet another red flag – talk about meta), how stable are Facebook’s revenues? We know that Amazon owns ecommerce. But above that, Amazon is also a leader in cloud services. Many many many many companies (some very large companies) rely on them for managing their IT infrastructures. This isn’t small, it’s a huge deal in the IT world. Personally I believe this is the future of Amazon and where they will grow extremely large and powerful.

Ok but that’s just one competitor, and maybe Amazon is wrongly priced, maybe it’s even under priced itself (or maybe overpriced too, it could be that Facebook is that overpriced – I’m not debating if Amazon is a good deal today, just that compared to Facebook, Amazon is a much better deal). But what about some other companies. Did you know that McDonald’s is cheaper than Facebook! Yes, it’s market cap is $90B. That’s 10% cheaper. It’s not growing anywhere the same rate, but still. Anyone heard of Visa? Yeah, that’s cheaper than Facebook! And it’s a company that continues to grow. And no one has any doubts that it’s profitable with their interest rates and all kinds of fees, etc. For the tech oriented there’s also Intel. Yes it’s a bit more expensive than Facebook, but it’s generating 15x the revenues and almost 10x the profits. And it’s revenues are growing (not at the same rate, but still quite nicely nonetheless).

So basically when you buy Facebook, you’re buying the stock with all of the growth of these companies already built into the stock price. In other words, you’re buying it assuming it will grow to the same size as these companies. It has to grow BIGGER than these companies for you to make any profit because the price already includes these gains! That’s a huge claim!

Of course we all know the stock prices are irrational and the price could go higher based on that irrationality, but trying predict irrationality is a fool’s errand and if you don’t jump out at just the right time, you’ll get severely burned. Not something I want to try my luck at!

I believe that the biggest reason Facebook is getting such a high valuation is because of it’s brand awareness. Almost everyone is familiar with Facebook. There’s even been a movie about it. Many many people use it. The problem is that most people don’t stop to think where and how Facebook makes it’s revenues. In case you don’t know, most of it’s revenues come from ads.

Yes it’s similar to Google and their ads (Adwords), except that Google has a major advantage over Facebook. People on Google are actively searching for something when they go to Google. They aren’t just perusing and maybe they’ll click on an ad, they’re actively searching for something, including the ads! With Facebook, the ads are a distraction. When you use Facebook, it’s to socialize. It’s not to actively look for products. You’re in a completely different mindset. You don’t go to Facebook to find something, you go to socialize. With Google you go to find things.

And since Google and Facebook share such a similar business model, it’s only fair to compare them. Google is priced at twice the price of Facebook ($200 billion market cap). Google’s revenues are growing quite well, similar to Facebook’s. But Google is generating more than 10x the revenues and about 20x the profits!! Not bad for twice the price. And you don’t have to hope it will make it, it’s already there!

So let’s do a comparable analogy of Google and Facebook. If I was to give you two options:

– Buy stock A for $1 that’s generating $0.61 revenues and $0.20 profit

– Buy stock B for $1 that’s generating $0.04 revenues and $0.01 profit

Which would you want to buy? It’s pretty clear and obvious isn’t it? Now let’s say I added another:

– Buy stock A for $1 that’s generating $0.61 revenues and $0.20 profit

– Buy stock B for $1 that’s generating $0.04 revenues and $0.01 profit

– Buy stock C for $1 that’s generating $0.52 revenues and $0.05 profit

In case you’re wondering, stock C is Amazon. In either case, as you can quickly see, Facebook is incredibly overpriced. At this time, Google would appear to be the best deal (best profits – and a higher profit margins!). Of course this quick analysis is missing a lot of factors such as growth, marketspace, etc. But it’s good enough to see the scale of the valuations of the different companies. Kinda makes you think doesn’t it?

So how is Facebook fairing since the IPO? Well firstly did you know that Morgan Stanley spent billions to support the initial IPO price point?. Yes the market wouldn’t bare the initial price so it had to be propped up.

And since then, the price has continued to decline. Right now as I write this the price is hovering around $31/share. That’s approximately a 18% price decline in just a few days! And the biggest tell of the stocks success will be when it releases it’s first real financial report as a public company. If it doesn’t meet the incredibly high expectations, well let’s just say the market has a history of not being too kind to such stocks. It will be interesting to see how Facebook does on its first filing after the IPO.

But do remember that for Google, as important as the big accounts are, Google Adwords has a lot of small accounts too. My company LandlordMax spends quite a bit on Google Adwords advertising each month. And we will continue to do as long as the ROI is positive. However many small businesses aren’t experiencing the same positive results on Facebook. Here’s just a few examples:

- Advertising your software on Facebook (=Fail)

- Pizza Delicious Bought an Ad on Facebook. How’d It Do?

- I put my family business on Facebook. Here’s what happened

- GM Says Facebook Ads Don’t Work, Pulls $10 Million Account

As you will quickly notice, the results weren’t just not positive, they were atrociously negative. As in extremely bad! To the point that it’s in not even worth trying to adjust and fix.We’re not just talking small companies with naive marketers, but we’re also talking large companies with large budgets. That’s why I can’t see the same expenditure levels on marketing for Facebook ad campaigns as are happening today with Google Adwords. Yet this growth is already assumed and calculated into the current stock price.

Again some people have shown success, but I have read too many similar articles like those above to dismiss them as just bad luck. Sure Google has similar unsuccessful stories, but they are rare in comparison.

Being an entrepreneur, I constantly talk to a lot of other fellow entrepreneurs, and I have yet to personally meet someone who has had a successful Facebook ad campaign. Again, some people obviously have had success, and you can find articles about it. I just don’t personally know any. Whereas with Google Adwords I know of many people actively using it with positive ROI, including myself. So as anecdotal as this observation is, it’s still an important observation for me. Firsthand experience down in the trenches is always very valuable and should never be dismissed.

But if you buy Facebook stock, then the price includes this growth in today’s price. It has to acquire all these customers and more to justify it’s current price! Any increase in market cap (stock price) is then based on further expected growth and not actual real growth. Sure signs of a boom with a very high potential for a large price drop.

And in my personal predication Facebook will NOT meet it’s expectations. Facebook is a cool system, and it’s great for social networking, but in terms of a advertising value for a company I believe it has limited value. Unlike Google where people are actively searching, with Facebook the ads are more like banner ads. And we all know that banner ads have atrocious click through rates, just like Facebook ads are appearing to have. Yes you can significantly improve your targeting, but does that really matter that much? It doesn’t appear to be making that much of a difference in terms of ROI for Facebook ad campaigns from the results we’re seeing. And I can’t see it improving. I also can’t see Facebook trying to compete in search. So I personally don’t understand how they will ever get the same ROI on ads as Google.

Now I’m not saying Facebook isn’t a good business, it definitely is a good business. And it can definitely earn revenues and is profitable. All I’m saying is that the current price of Facebook is not inline with the value of its business. It’s too overpriced. If the price dropped significantly I would probably start to get tempted. But right now, it’s just insanely priced for what you get. Which means the price of the stock only has one direction to go, DOWN! Maybe not today, but give it a 1-3 years and it should better line up with it’s real value.

In either case, we’ll know soon enough. I’ll definitely have to post a follow-up in a year or two to see what happened between my initial predication today and then.

Update: Looks like the Facebook IPO is about to get quite messy!! It appears that the earnings estimates for Facebook were downgraded for the IPO but not everyone was notified. Firstly it’s very odd to do it at the very last minute of an IPO, but what’s even more worrisome is that some bigger investors were notified which is considered insider information. This could get really ugly real quick!!

Update 2: It’s quickly escalating. It now looks like Morgan Stanley, Goldman Sachs, and JP Morgan, along with Facebook itself, are being sued by investors claiming to be misled in the purchase of the Facebook IPO. If you thought Martha being sued for insider information and trading was a big story, this is going to explode in comparison. One of the largest IPO in history, an over-hyped IPO, investors losing 20% in two days, large dollar values of insider trades, a high profile company, it all has the making of one of the biggest stories of the year. I’ll even predict that a movie, even if it’s just made a made for tv movie, along with at least 2-3 books, will be released within a year.

Permalink to this article Discussions (2)

Groupon – Back to Crazy Company Valuations

Just when I thought we were finally over the craziness of obscene IT company valuations of the 2000 dot com bust, I see Groupon’s latest valuation. $15 billion dollars for Groupon? That insanity! And although Groupon isn’t the only one getting ridiculous valuations, it’s definitely one of the worse along with Facebook’s $50 billion valuation from Goldman this month.

So let’s look at some numbers. And I’m not even yet talking about revenues or financials, let’s just look at the recent valuations. There’s no way the company’s growth is in line with the growth of its valuations.

In April 26, 2010, it was valued at $1.2 billion. This is when they said they expected to make $100 million for 2010. Shortly after this, Google offered Groupon somewhere between $5 billion to $6 billion, which they turned down. This month, based on their latest financing round of $950 million, Groupon has a valuation of $15 billion. Yes, that’s right $15 billion!

All this from a company that was spun off as recently as 2007, that only really started its web presence in late 2008. Now I’m not saying you can’t make large amounts of money in that amount of time, but creating $15 billion dollars of value, it’s not very likely.

But before I get too ahead of myself, let’s look at some concrete numbers, just to make sure I’m not the one who’s out to lunch here. Initially Groupon estimated it would make $100 million for 2010. It now appears that this number needs adjusting and they will claim upwards of $350 million in revenues. This is really good news, and it does explain why there’s so much hype for this company. My congratulations to Groupon for that kind of growth, it’s amazing!

But before we get ahead of ourselves, we need to realize that not all of Groupon’s revenues is theirs. Remember that Groupon has to pay up to 50% to the merchants. That means that their real revenues are probably closer to $150 million. In other words, the stated revenues are highly inflated, because although it’s revenues it’s not really real revenues. Unfortunately that’s going to help them get better valuations, especially if they become a publicly traded company. Most people just aren’t going to take the time to determine exactly how a company earns it’s revenues, they just quickly look at the numbers (if that, many just go with brand names or the hype associated to the a company). If you’re interested in more detailed analysis of Groupon’s revenues, Paul Butler has written a really good article. His analysis is pretty thorough and I agree with his findings.

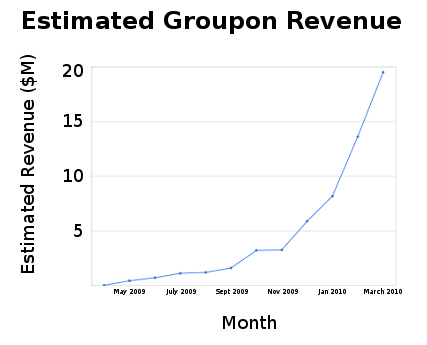

In any case, ignoring the issues with actual revenues, if you graph those revenues based on the available information, you get a revenue graph that pretty amazing (see below – source: Paul Butler). The growth curve is definitely something to write home about!

But even with that kind of growth, are the valuations worth it? Can it sustain that growth over time? Will the growth slow as the company grows? The bigger a company gets, the harder it is to maintain high growth levels. It’s much much easier for a $1 million dollar company to double in size than a $1 billion company. How often do $100 billion dollar companies double in size?

But most importantly, what is the premium paid for that growth today? In other words, how long do they have to continue that growth to get a reasonable valuation?

The best way to find out is to calculate the premium, for example using metrics such as P/E, and even that won’t really work because we don’t have enough information about Groupon (it’s a private company). But let’s go ahead and do a close enough comparison anyways, let’s do a P/R (Price / Revenue). Assuming my numbers are correct, that’s a P/R of about 43 based on total revenues. However if I make an adjustment to use their real revenues, the P/R skyrockets up to about 100.

Although we can’t do an accurate P/E calculation, we can do a quick ballpark calculation. Assuming 50% of that revenue goes to the merchant, we’re left with $175 million of revenues to make a profit from. Assuming another 50% for operating expenses (meaning a 50% profit which is very high and generous), that leaves us with $87.5 million in profits. Therefore as a quick ballpark, we’re looking at a P/E of 171 for Groupon!!! Is it just me, or is this P/E value all too reminiscent of the Dot Com Boom and Crash of 2000? And that’s just one metric. By the way, if we use a 35% cut rather than a 50% cut for the merchant, we still get a P/E calculation of 132. This is just as insane as 171.

And if metrics aren’t your cup of tea, maybe we can do direct comparisons of Groupon to existing companies with similar market valuation? Here’s a small list of companies valued similarly to Groupon.

| Company | Valuation | Revenues |

|---|---|---|

| Adobe | $17.03 billion | $3.8 billion |

| Best Buy | $13.93 billion | $49 billion |

| Staples | $16.83 billion | $24.2 billion |

| Symantec | $13.83 billion | $5.98 billion |

| McGraw-Hill | $11.54 billion | $5.95 billion |

| Groupon | $15 billion | $0.350 billion |

Do you know what the first thing I noticed in this list, not one of these companies has revenues below a $1 billion other than Groupon, or even several billion! Although I have to admit I haven’t done the most thorough search, I don’t think you’ll find many, if any, stocks with these kinds of valuations in the public market. The numbers just don’t make sense.

The premium on Groupon is such that you’re paying for it as though it’s already a very large and mature company. That is, the built-in premium on the company is so large that it would have to continue the same level of growth for at least a decade or more. The odds against that are extremely low.

I also believe every single company on the list above is worth more than Groupon. But don’t take my word for it, let’s look at another comparison. Let’s look at the valuation to revenue ratios. From our list above, the best (largest) ratio (other than Groupon) is from Adobe at 4.48. Groupon’s ratio is 42.85! That’s 10 times more than the best ratio on that list. If you can find a company that has even close to that ratio, that’s listed on either the Nasdaq or NYSE, then please let me know!

Using the 4.48 ratio, which is the best ratio (highest premium), that would make Groupon worth $1.5 billion. If we use the lowest ratio (Best Buy with a 0.28 ratio) that would make Groupon worth $98 million. Which means that Groupon should be valued anywhere from $100 million to a max of $1.5 billion according to this list. I agree the sample size isn’t very large, but this is a fairly common sample of companies at these valuations. As you get to valuations of this scale, the premiums start to diminish. It’s understandable for smaller companies that can grow faster, but at these scales it’s much more difficult to get similar growth rates for larger companies.

Anyways, do any of these companies really compare to Groupon in terms of value? If someone gave you the option of getting $x of stocks in only one of these companies, and you had to wait at least 3, 5, or even 10 years to sell, which company would you select? Is Groupon worth 10 times as much as those companies? I personally don’t think so. Do you?

Permalink to this article Discussions (1)

The Sunk Cost Effect

There are many many many many many books that teach you how to make money, but almost none that show you how to avoid losing your money. I personally had never really thought about this, at least not until I read the book What I Learned Losing A Million Dollars (an amazing book that I strongly recommend). Like everyone else, I was more concerned about making money rather than about how not to lose it. But as Jim explains it, there are many ways to successful make money but few to lose it all. You can invest in opposite strategies and still make money! The key to long term wealth is to understand the psychological forces that induce us to lose our money, even through our best efforts.

The book What I Learned Losing A Million Dollars starts off with Jim’s personal story of how he quickly climbed up the success ladder and then in a matter of a few months lost his entire wealth. What’s most interesting about the book is that what happened to him could happen to anyone. But the scariest part is how fast it can happen. It’s not that he did stupid things or spent wildly, it’s that he got caught up in a psychological trap. One that we all fall prey to from time to time, just on smaller scales.

Once it was all over for Jim, he went on a quest to find what the best investors did. What he found is that there was no consistency, they were all over the place. Many of them contradicted themselves and still succeeded. This lead him to question how this was possible, after all in most cases when two people use the opposite strategy one person has to come out ahead at the expense of the other. That’s how the markets work.

What he found out was that this wasn’t necessarily true. What happens is that successful investors know when to stop, when to drop an investment. Investors using opposite strategies aren’t always in the market, they’re in the markets at different times. They know when to wait on the sidelines until the markets favor their strategy. They don’t fall prey to as many psychological traps as ordinary people do. That is the only common thread he was able to find for highly successful investors!

And today we’re going to discuss one of those very common traps. It’s the effect of looking at your previous costs in determining whether or not to go forward today, otherwise known as the Sunk Cost Effect.

To give you a common example unrelated to investing, just to show how prevalent and strong this effect is, let’s take the example of car ownership. Let’s assume you own a car that’s a few years old (still pretty new) and you’ve just spent $2000 in repairs on it a couple of months ago. Suddenly this week it starts misbehaving, you bring it to the garage, and find out you need to spend another $1000, $2000, or even say $4000 on it. What do you do?

The best answer is to look at the value of the car TODAY and determine if it’s worth it TODAY. However, and this is where we almost all fall prey to the sunk cost effect, is that we also look at the fact that we just spent $2000 a couple of months ago. We’ve already spent that much money on it, so we might as well go forward with the new repairs. We don’t want to lose that $2000 in repairs from a couple of months ago. We may even rationalize that what we fixed a couple of months ago won’t break down again for some time so the car is better for it. And that’s a big problem!

What happens now if in another month we get another bill for another $2000? Well you have to get the repairs, after all you just spent $3000-$5000 in the last few months. And then what happens in another couple of months if it repeats. Oh my god!! We just spent $5000-$9000, there’s no way we want to lose all that money and/or effort. And so the vicious cycle has started and we start to lose more and more money just because we didn’t want to lose that initial $2000!! Trying to avoid losing that initial $2000 repair bill has now cost us around $10,000, and it’s only going to get worse! If the car is a lemon, how long will it take for us to give up? If you think it was hard at $2000, imagine now at $10,000! The more you lose, the harder it gets to pull out!

And it’s not just with cars, it can happen with just about anything. It can happen with your job. You may have already committed 3, 5, 10, 20 years to this job. You may hate it, it may be paid below market rates, and so on. But since you’ve already committed so much to it, you’re probably less and less likely to quit with time. This is why people get caught up in jobs they don’t like for years and years.

With investing, in real estate it could be you’ve already spent so much money renovating a property that you now have to wait to sell it until the market recoups, losing money each month for years and years, possibly losing everything through bankruptcy to avoid losing that $10,000 you initial spent on renovations. In the stock market, it’s a stock you bought at too high a price that you’ll now hold onto until it goes back to at least it’s original price. The list goes on and on.

The reality is that we should always look at whether something is worth it as of today. Period. It doesn’t matter how much time or money we spent on it in the past, we need to look at how much it’s worth today. If you can do that, you will save yourself a lot of trouble and money!

And that’s what smart investors do. They evaluate an investment in terms of what it’s worth today, they don’t look at how much they’ve already invested. In other words, you should always ask yourself: If I wasn’t already committed would I invest into this today? If the answer is no, then you need to seriously consider getting out of your investment before you fall prey to this trap, otherwise it will be that much harder as your position gets worse!

Permalink to this article Discussions (1)

Top Entrepreneur Movies to Watch

In no particular order:

|

Wall Street (1987)

There are numerous lessons to be learned from this movie. It’s probably THE most famous business. What’s more, it’s still amazing today, 20 plus years later! Some of my favorite quotes include: “It’s not a question of enough, pal. It’s a zero sum game, somebody wins, somebody loses. Money itself isn’t lost or made, it’s simply transferred from one perception to another”. “Life all comes down to a few moments. This is one of them”. The most valuable commodity I know of is information”. And probably the most quoted: “Greed is good.” Although the above quotes are mainly about greed, which is the central theme of this movie, there are many many many lessons to learn. There’s ambition, taking chances, the power of information, and so on. An interesting tidbit, one of the pivotal scenes of this movie is quoted as part of another movie in this list (The Boiler Room). |

|

Startup.com (2001) The story of a group of friends from high school who decide to start a dot com business at the height of the dot com boom (aka mania). It starts off as you would expect, with lots of excitement and energy. But as the business grows, VC money becomes more and more important since there is no real revenues. To avoid spoiling the movie for those that haven’t seen it, let’s just say a lot of issues have to be dealt with. This is a great movie for people thinking of starting a business with a group of friends, of exactly what can happen and what you should discuss beforehand. Plus it show the importance why a business should be run to be profitable. The whole movie is really about getting the next round of VC (Venture Capital), it’s not about how to grow the business to earn more money. I don’t even remember this being discussed once in the whole movie! |

|

The Secret of My Succe$sThe Secret of My Succe$s (1987)

The Story of an ambitious young man who wants to conquer corporate America. Although he doesn’t climb through the proper channels and there’s plenty of 80’s style “you can do anything”, there’s lots of good lessons. For example, in the movie he was able to climb just by filing the proper paperwork! Some great lessons include the power of charisma, the power of information, the value of social networks, and so on. Although this may be a more arguable point, that sometimes it takes a bit more than hard work to get ahead, you also need to create your own luck. I would of course not recommend creating luck the way Brantley (played by Michael J. Fox) did in the movie, but the idea is that he took his destiny into his own hands. |

|

Jerry Maguire (1996)

Ignoring the two big quotes from this movie: “You had me at hello” and “Show me the money”, this movie is what entrepreneurship is all about. Jerry is a successful agent for his clients at a large firm when he comes to the realization that things aren’t working for him. He writes a mission statement of what the company should be, where agents should have less clients so that they can foster better relationships. Needless to say, this doesn’t go well. So he sets off on his own to start his own company with his own clients which will be run according to his mission statement. He will focus his business on managing less clients but taking more time and effort with each client. On building relationships with them. And like any business, the start can be rough. It never quite goes as planned (it honestly rarely does – double to triple your estimates, and not your best estimates), and in this movie he almost loses everything. But he is able to pull through, and he does succeed. |

|

Hitch (2005)

You might be wondering why this movie is in the list, it’s because it’s not just about romance. Business is about understanding your customer’s problems and finding solutions to those problems. In this case Hitch is a successful consultant not only because he’s good at what he does, but also because he’s figured out what his customers want, even when they don’t really know it. What’s also interesting is this is one of the few movies you see someone be selective with their customers, and even fire their customers. Hitch interviews all his clients to make sure their intentions are good, and only then will he work with them. If he finds out later that they aren’t, he immediately fires them. All around a good movie showcasing the importance of understanding what your customers problems are and finding solutions for them. As an added bonus, he always demonstrates the power of word of mouth marketing! His business is not exactly something you want to advertise on a billboard, so it has to be through word of mouth. And he is successful. |

|

Forrest Gump (1994)

Shrimp anyone? Even Lieutenant Dan didn’t believe Forrest could start a shrimping business. The main lesson here is that it doesn’t take brilliance to start a business, anyone can. Sure Forrest had a little luck because of a storm that wiped out his competition, but had he not tried he never would have gotten anywhere. And he definitely wouldn’t have been on the cover of Fortune Magazine as depicted in the movie. Starting and running a business takes more than skill. It takes a lot of hardwork. But most important, you have to actually start the company! As I’ve said before, Ideas are a Dime a Dozen. Not to downplay them, but the concept is that coming up with an idea is not hardest part of a business, executing the idea is. And in the movie, we see Forrest does just that! |

|

Baby Boom (1987)

A high powered executive (known as the Tiger Lady) inherits a baby and suddenly finds her life turned upside down. She eventually makes the decision to move away to the country to raise the baby. Once there, she comes across the idea of creating high quality baby foods for a niche market. Being the 80’s and all, there’s the classic montage of her building her business into a very successful business, so successful that her previous company offers to buy her out. The biggest lessons learned from this movie are about the importance of niche markets. How it’s important to focus on thing and be the best at that thing. Had she created another brand of baby food, it would’ve just been another baby food company, and she would’ve had no chance. Instead she found a segment of the market she wanted, then she spend some time analyzing that market for it’s potential (yes, you actually see her analyze her market segment/niche in the movie). It’s important to have a USP (Unique Selling Proposition), and J.C. (the high powered executive) definitely figures hers out. |

|

Boiler Room (2000)

You would think this is the movie to show you what not to learn about business because it’s all about scamming your customers. True, I agree, but there are still several things to learn. My favorite quote: “And there is no such thing as a no sale call. A sale is made on every call you make. Either you sell the client some stock or he sells you a reason he can’t. Either way a sale is made, the only question is who is gonna close? You or him? Now be relentless, that’s it, I’m done.” That’s right, this movie is mainly about high pressure sales tactics. Although I personally disagree with this kind of sales tactic, but it’s still important to understand because it will eventually be used on you. They also discuss about market segmentation, but not exactly in those terms. They discuss how some customers are more profitable then others, and how to identify them. How to determine which are the fat whales. There are some other great lessons in this book, especially the importance of questioning a too good to be true deal. You’ll definitely get learn something from this movie. |

| Pirates of Silicon Valley (1999)

Who doesn’t know Bill Gates or Steve Jobs? What better movie can there be on business than the story of how those two started their companies. Although it’s not exactly known for it’s accuracy, it’s still an amazing movie with a lot to learn from. These are two different people that both succeeded wildly yet took very different paths to success. What’s also very interesting is the impact of some of the decisions they made early on. There’s a saying that basically goes along the lines of, you can be good in business and succeed, but you need to be both good and be lucky to succeed wildly. They were both good, and fortunately for both for them, they also both made some very good decisions early on. |

|

|

Office Space (1999)

How can this movie not be on the list. It’s a classic! Of course it’s not so much about learning how to run a business as it is about how NOT to run a business! But still this movie is just too hilarious to leave out. Examples of how not to run your business include TPS reports. Or having a dozen managers ask you about your TPS report. Can you imagine having to deal with that many managers? One of my favorite quotes is: “Yeah, I just stare at my desk; but it looks like I’m working. I do that for probably another hour after lunch, too. I’d say in a given week I probably only do about fifteen minutes of real, actual, work.”. How can you expect any company to excel and lead if you’re people are that de-motivated. |

|

Cocktail (1988)

In this movie Brian (played by Tom Cruise) is a very ambitious young man excited to get his start in the business world. He quickly learns that none of the big companies are interested in hiring him without a degree, so he unrolls at the local city college and starts a part time job where he meets his counterpart for the movie. Together they go through quite an adventure. They decide they’re going to open their own bar called Cocktails and Dreams. But to do this, they need money, and this is where they start to diverge on their paths. This also where the biggest lessons can be learned. Having a business partner is not something to do on a whim. It’s very difficult, you need to have the same goals, you need to be able to work together through the tougher times, you basically need to work better together than an old married couple. Above that, and the usual business lessons, another interesting aspect of this movie is that not all money to start your company is equal. That is to say, just because you can get money, it doesn’t mean you should. It may or may not be worth the costs. So be careful when you take money for your business, make sure it’s worth the cost for you, not just personally, but also that you’re not giving away too much for it. |

|

Rudy (1993)

Rudy is here because it’s so inspirational. Rudy is a movie based on the true story of a “5 foot nothin’, 100 and nothin’ with barely a speck of athletic ability’ man who achieved his dream of playing in a football game for Notre Dame. No one believed he could, not even his family or friends, no one. However through sheer will and determination Rudy was admitted to Notre Dame, got on the football team, and got to play one game. That’s amazing considering he had everything going against him! He worked hard, he persevered where most people would’ve quit. He worked so hard that when the coach said he wasn’t going to be able to play him on his last possible game, the football team revolted and refused to play unless he got dressed. Not only that, they got him on the field. And best of all, as far as I understand Rudy was the only person ever to be carried off the field on the shoulder’s of the other players. That’s how much they respected his dogged perseverance! |

|

Trading Places (1983)

In this movie two investors/businessmen decide to make a $1 bet to see if they can turn a successful person into a homeless criminal and homeless criminal into a succesful business person. It has all the charm of an 80’s comedy. But above that, the two main characters invest and work the commodities market, along the way exposing mis-perceptions about the American Dream. And as a benefit, you’ll actually get to learn about how the commodities market work. And if you’re a bit confused by how the end goes, the following is a good explanation. |

|

Working Girl (1988)

Ignoring the massive 80’s Big Hair, this movie is the story of Tess’s climb up the corporate ladder during the big Merger & Acquisition fad of the 80’s. Above the normal business lessons, this movie really shows the importance of social skills in business. Not only do you need to be smart, but you need to be able to work with people. You need to understand other people’s needs. You need to be able to communicate with other people. And most importantly, it really helps if other people believe in you. |

|

Aviator (2004)

This is the story of Howard Hughes, from his beginnings all the way to the end. Even though Howard had some personal issues, but he was still an amazing businessman. How many people are willing to make the types of bets he did on succeeding? Betting the whole company many times over? There’s no doubt he was a very smart person, but he also had a lot of ambition and was willing to put his money where his mouth was. And not just on a small scale, but on a massive scale. What I found most interesting is that all the while he was creating and growing his company he was also battling some very big inner demons. He was able to succeed where most people would’ve crumbled, and he built a largely successful company above that. |

|

Newsies (1992)

Business is not all about making smart decisions and executing on them, it’s also very much about the people behind the business. Without people there is no business. And this movie is in this list because it shows the importance of people. Not so much about getting the right people, that’s another lesson, but in treating your people right. In the movie, the owner of the newspaper company basically decides to decrease the pay of the newsies, which they don’t appreciate. This leads to a strike. Do remember of course that this movie takes place many years ago, when child labour was common and striking wasn’t unionized as it today. In any case, the lesson here is to remember to treat your employees well. This not only includes paying them what they deserve, but also treating them the way you’d like to be treated. It will make a difference in the long term, as Hearst (the owner of the newspaper company) learned the hard way. |

|

Click (2006)

As important as your business is to you as an entrepreneur, you also have to realize that there are other things that may be even more important. In this movie, Michael (played by Adam Sandler) learns the hard way that climbing the corporate ladder isn’t the most important thing in his life. His family is the most important thing. When starting, and even when running a largely successful company, too many entrepreneurs focus solely on their companies forgetting almost everything else, even their own basic health! And in some cases, they sometimes wear this as a badge of honor. Yes your business is important, but is it the most important thing in the world? You should always ask yourself what the most important thing in the world would be if you had a heart attack today? |

|

Risky Business (1983)

First there’s the obvious standard business lessons. You need a product that people want. You need to market it. You need to … But what’s more interesting is the underlying theme of this movie, which is how greed can corrupt people. Joel starts off innocently enough, but by the end of the movie his business venture isn’t exactly what you’d call mainstream. Mainstream or not though, all businesses obey the same core principles. As he describes at the end, his business is “Dream Fulfillment”. Find what a customer needs and fill that need. |

|

Tucker: The Mad and his Dream (1988)

To quote the tagline: “When they tried to buy him, he refused. When they tried to bully him, he resisted. When they tried to break him, he became an American legend. The true story of Preston Tucker.” If his story doesn’t inspire you to build your company, I don’t know what will. What’s great about this movie is that it shows that sometimes you need more than sheer will, you also need a bit of salesmanship to go along with it. You need to to sell people on your idea, and more importantly on you! |

|

Gung Ho (1986)

Although dated, this film shows that business isn’t just about ideas and execution, it’s also a lot about culture. And although this movie is about the 80’s business Japanese business culture clashing with the 80’s American business culture, it’s about a lot more than that. Mergers and acquisitions aren’t always as rosy as they appear on paper. Just because two businesses can appear to have “synergy”, it doesn’t mean they will work well together. But the biggest lesson to take away is that all business have cultures that get established within them. These cultures can be good or they can be bad for the business. It’s therefore very important to cultivate cultures that will benefit the company, especially because it’s extremely hard to change them later. |

|

Tommy Boy (1995)

“Holy Schnike”, Tommy Boy is on this list? Yes it is. Why? To quote Ray Zalinsky (played by Dan Aykroyd): “Truth is, I make car parts for the American working man because I’m a hell of a salesman and he doesn’t know any better.” In other words, a great product doesn’t make a great business. It sure helps, but it doesn’t guarantee you’ll succeed. Betamax was better than VHS. The Mac was better than Windows in the 90’s. There’s countless examples of products that were superior but lost out. To succeed at business you need to be able to sell and market yourself. |

|

You’ve Got Mail (1998)

Although the central theme of this movie is the love story between Joe Fox and Kathleen Kelly (played by Tom Hanks and Meg Ryan), it’s also about a small company having a big competitor move into it’s market. It’s generally better if you can be the aggressor, but if not, you need to be prepared and learn how to differentiate yourself. In this movie Kathleen’s store is very different from Fox Books, it’s personable, it’s memberable, and so on. But it’s still not enough to compete with discount prices on commodity items (the same book can be purchased cheaper down the street). She wasn’t able to learn how to differentiate herself enough before it was too late. Therefore the lesson here is don’t try to compete head on with a big company on their terms, find another way to compete with them on your terms, one which you can hands down beat them. And go from there. |

|

Family Man (2000)

With anything else, you need to have balance. And to reach the very top of success requires a lot of sacrificing, which Jack (played by Nicholas Cage) has done in this movie. But is it worth it? Is all the money worth it? Maybe, maybe not. Assuming you don’t want to be the very best of the best, it’s important to realize that starting a business does require some sacrifices. If you want to start a business at night and on the weekends, then that’s coming out of your free time. Also expect it to take a long time, there’s no way you can do it in just a few short months. If you want to go even bigger than that and quit your job, then expect to be working more and harder than your full time job to get your company started. Success does require a great deal of effort, it isn’t easy. Otherwise everyone would be doing it. |

|

In Good Company (2004)

The most obvious business lessons to take from this movie is that there are multiple ways to successfully run a company. And there are the multiple approaches to building up your client base. In the movie Dan does it through social networking while Carter does it through cross-promoting, etc. Both are very successful in their own ways. Another lesson I personally cherished is that just because there’s a new way to do things, it doesn’t mean it’s always the best or right way. In many cases it is, but not always. How many of you remember the main business strategy of the dot com era? The idea of getting as many eye balls on your company’s website as possible, no matter what the cost. Dominate the market segment and then figure out how to be profitable. Always, always, listen and understand why it was done the way it was done before you jump into a new way of doing things. |

Honorable Mentions

The following are more great business related movies that you can benefit from watching, movies that I could have made fit in this list but would have made the list too long to read. They include:

- Click (2006)

- Clerks (1994)

- Mr Mom (1983)

- For Love or Money (1993)

- Greedy (1994)

- Fun With Dick and Jane (2005)

More Mentions

The following are related movies that are suppose to be really good but that I just haven’t yet seen:

- The Triumphs of the Nerds (1996)

- Glengarry Glen Ross (1992)

- E-Dreams (2001)

- Barbarians at the Gate (1993)

- Rogue Trader (1999)

- Code Rush (2000)

- Big Night (1996)

- The Corporation (2003)

- Capitalism: A Love Story (2009)

If I missed any please add them below in the comments.

Permalink to this article Discussions (2)

How to Get a Pay Cut AND Be Happy About It

Let me start by asking which you’d prefer:

- A 10% raise?

- A 3% raise?

If you’re like almost everyone, the answer is hands down #1. But let me re-phrase the question a bit. Which would you prefer?

- A 10% raise in 1980?

- A 3% raise in 2009?

Is your answer still the same? I bet you think it’s a trick question because I added a year to the options. You’re right, it IS a trick question! The years 1980 and 2009 are special. Can you guess why? 1980 is very well known for having a very high inflation rate whereas 2009 is known for being a deflationary year (a year where the inflation rate is negative). In 1980 the inflation rate was 13.5% whereas in 2009 it was -0.4%. Having brought this new information to light, is your answer still the same?

In other words, which do you prefer:

- 10% raise at 13.5% inflation in 1980 = a real -3.5% raise in terms of purchasing power

- 3% raise at -0.4% inflation in 2009 = a real 3.4% raise!

Looking at the numbers adjusted for inflation, option #2 is now by far the best economical choice, beating option #1 by almost 7%!! Option #1 is actually a pay cut!

Now here’s the kicker, although most people realize option #2 is the best economically, the majority of us FEEL that the person in option #1 is HAPPIER with their raise than the person in option #2. Notice here I said feel happier, NOT that they were financially ahead! Although we’re able to differentiate between the two, most people still believe they would feel happier with option #1!!

What’s more, this same research paper (Money Illusion) also discovered that people believe the person in option #2 was more likely to leave their job. Basically, as William Poundstone summarized in his book Priceless, the overall theme of the paper is:

“$$$ = happiness = actual dollars NOT ADJUSTED FOR INFLATION”.

So how do you get a pay cut and be happy about it? Get a raise, but have that raise be less than the rate of inflation.

Permalink to this article Discussions (0)

Why I Have So Many Printers

I hate to admit it, but I have more printers than I have computers. Why is that? Is it because I love printers? Not at all. It’s because it’s economically cheaper to buy a new printer almost every time I run out of ink.

For example, today on Amazon I can buy the Canon iP3600 Inkjet Photo Printer for $43.08. Don’t be fooled by the sale price, just do an Amazon search for printers in the $25-$50 range and you’ll find lots of printers in that price range. Many are cheaper than this Canon printer, I just picked it because the discount wasn’t as heavy as some of the other models.

Now if we look at the price of ink cartridge to replace it, what they call the value pack, to replace all the colors including black, it comes to $41.05. Yes, it’s actually cheaper to buy a new printer than to buy ink. And I get a new printer!!

I understand that ink is where printer manufacturers make their profits, and that more often than not the printers themselves are loss leaders, but this is a bit ridiculous. Is it just this one case?

Epson has a WorkForce 30 Color Printer selling for $59.99. To replace the ink requires a $16.49 purchase for black ink and a $32.99 purchase for color ink. Combined, that’s $49.48, just $10 shy of a brand new printer!

And it’s not just Canon and Epson that do this, pretty much all printer manufacturers are in the same boat. Too often the price of replacing the ink is equal to or greater than the price of a new printer.