Why do Real Estate Investors Not Invest in Stocks the Same Way They do in Real Estate?

Although it’s a discussion I’ve had a number of times before in the past, this weekend it re-occurred again. Although not directly in the context of investing in real estate, the concepts are the same. Basically, I’ve seen this happen over and over again, people who invest wisely in other assets (business, real estate, etc.), don’t always use the same principles when investing in stocks. I don’t know how the last people I had this last discussion with invest (we didn’t discuss those details), but the discussion did come up which prompted today’s article.

Often I see many wise real estate investors, wise business owners, and so on, look at the whole of their related investment, do their due diligent, and then only invest in income generating ventures. However these same people will then often completely ignore the same investing principles when dealing with other assets such as stocks! How? Why? I don’t know. If you look at a buying an investment real estate property, you will look at its total cost, at its cash flow, etc. When looking at a stock, you should do the exact same thing. Same concepts, same principles, same research. However the reality is that most people don’t.

In this article we’ll go over how and why you should look at stocks the same way as buying other assets such as investment real estate, businesses, etc.

Let’s start by looking at a basic deal. When you purchase an investment real estate property, you’ll want to look at the total price of ownership to decide if the property is expensive. That is, you want to know what the property is selling at. If you buy a business, say a Subway franchise down the street, you also want to know how much it’s going to cost you to invest in it.

When people buy stocks, more often than not, they want to know the stock price. Then based on this stock price they’ll determine if the stock is expensive or cheap. That doesn’t work! Think about it this way, stocks are only partial ownership of the company you buy stocks in. If you buy a share of Microsoft at $10/share or $40/share, you don’t own the price of the whole company, so how do you know if that’s expensive? If I sold you part of a real estate property for $10 or $40, how do you know which is worth more? You DON’T! You can’t with just that information. Why? Because how do you how big a piece of the pie that share is worth? What if for the $10 a share of the real estate property I sold you there are 1,000,000 shares? That makes the property cost $10,000,000. Now what if I told you the $40 a share real estate property only had 10,000 shares, making that property cost a total of 400,000! That’s a drastic difference! That’s the reality of stocks. That’s why many people fail at investing in stocks. If someone doesn’t even know the total cost of ownership, then how can they be investing? That’s gambling. If I bought an investment real estate property without knowing how much it truly costs, then how could I be expected to make a profit? I couldn’t! Whether or not I did would just be luck.

It’s very easy to get the total price of any publicly listed company, that’s what called the market cap. The formula is as simple as I stated above, the total number of shares multiplied by the cost of each share. This number of course changes daily, because stock prices change, but in any given instance you can quickly determine the total price of a company. Because it changes, don’t expect to be 100% accurate, just use it as a ballpark figure. Like in our example above, we can quickly have an idea of what’s what without needing to know it’s precisely $40,192 versus $40,000 compared to precisely $10,234,725 versus $10,000,000.

Now that we know how to calculate the total cost of ownership, then the next thing that should come to your mind is what is its true value? One theory, the efficient market theory, states that the market always accurately reflects the true value in the stock price. That is to say, the stock is worth what its selling for because everyone has all the information now and can correctly evaluate it. The reality is that it’s not efficient! Stocks are bought by many people, many who know what they’re doing, and many who don’t. Stocks are bought on gambles, stocks are bought on information, stocks are bought on name recognition, stocks are bought on tips, stocks are bought on emotions, stocks are bought for almost every reason.

What this means is that the actual value of a stock is not necessarily what it’s selling for, just like real estate, just like businesses. However the good news with stocks is that the discrepancies can be much larger than they will ever be for real estate properties. For example, if you look at the dot com boom and bust, the discrepancies were incredible! At other times, in a down market, prices can also be much below their true value. It’s possible to buy stocks for much less than they are worth, just as it’s possible to buy real estate much below its true value. The difference is that with stocks, because they are so easy to buy and sell as well as having a low barrier to entry, these fluctuations can be much bigger and faster.

Now that we know that the real value of a publicly traded company and its stocks are not always the same, how do we determine its true value? This is where it gets a little more complicated. There is a lot of debate here. You can talk about trends, you can talk about potential, deals coming up, patents, etc. That’s all fine, but for the scope of this article, we’ll only focus on hard nosed financial facts and figures. How much equity does the company really have? The first place to look is the balance sheet (which is available through SEC fillings and many online sites such as Yahoo Finance).

For our example, we’ll use a really well established company like Microsoft through the Yahoo Finance website. Generally balance sheets are divided into two sections, assets and liabilities. This is just like any investment real estate property or business. In assets section you want to know the hard values of the items you’re purchasing. For a publicly traded company, the easiest hard asset is cash. What’s the cash balance? For Microsoft in June 2005 it is $37.75 billion. That is, if the company went bankrupt tomorrow, assuming no debt, they could give out $37.75 billion to all the shareholders ($3.52/share).

What other hard assets can a company have? Many. It can own factories, inventory, etc. The only issue I have with this is that if the company went bankrupt tomorrow, you might not be able to sell these assets at full value. Therefore you should recalculate the balance sheet to reduce the assets at a discounted value. How much? That depends on the industry and how much security you wish to pad your price with. I like to be conservative myself, so I really low ball these assets.

One word of warning when calculating other assets, there are two rows you need to be extremely careful of, they are intangibles and goodwill. Without going into too many details, these are items that have no real hard assets behind them, that is if the company disappeared tomorrow, that value wouldn’t be paid out in cash to you. Examples can include the value of a brand name. How much is the name brand “Coke” worth? “Microsoft”? That is how much people buy their products because they know the name. The answer is that it depends. It’s worth something, but how much can’t really be determined.

Another item that’s often added here is the premium paid when a company acquires another. For example, if a company acquires another that was going for $1,000,000 but they paid $1,250,000, then you would add $250,000 as goodwill. This is the premium paid to acquire a company (which is very common). Therefore to be safe I completely discount these two rows because to me they have no really definable value that I can easily equate. This is just like how much is it worth to have beach front property? It’s definitely worth something but how much exactly I don’t know, there are just too many variables to be anywhere near accurate. Therefore to be safe I don’t assign any values to it and therefore I’m excited when I find a beach front property that has a balance sheet exactly as one that isn’t beach front!

The second section is debt. Debt can be your friend, but in business it’s a liability. These are payments you need to make every month. You need to verify that the company you are buying is not overloaded with debt. This is the same as verifying that you yourself are not overloaded with debt when purchasing a real estate investment property or a small business. You need to verify that the company can service its debt otherwise it will go bankrupt. What’s too much, well that depends again. Each industry is different and each business is different. I personally like to play it safe and avoid companies that have more than 25% of their cash reserves in debt. I understand this is stringent, but I don’t like to lose! No debt is even better when it comes to acquiring a business. Imagine if you could buy two real estate investment properties for the same amount of money, but one would require you to be in debt while another wouldn’t. Which is better?

Another thing to avoid is companies that grow through solely through debt. You can grow through debt, but eventually a company will cap out. Think of it this way, if the only way you could grow your real estate portfolio is 100% through financing (not from re-investing profits from your current properties), then eventually you will get crushed by a downturn in the market or by a lack of acquire future funding. You want some margin for safety. If I went out and bought every rental property I could with 100% financing, at some point I would get crushed. I might last a while, but if interest rates climb by even a small rate, or if one of my properties has some problems for even a short time, I’m at risk of collapsing my entire portfolio. The same is true for companies.

Now that we quickly looked at the balance sheet, what about the cash flow statement? When you buy an investment real estate rental property, you should definitely look at cash flow. Is the company consistently generating positive cash flow? Would you buy a real estate rental property that’s generating negative cash flow (assuming you couldn’t do anything to fix it yourself because you can’t personally manage a publicly traded company either)? I wouldn’t. So why is this important aspect so often ignored? I wish I knew… However, the reality is that it is often completely overlooked.

Looking at a publicly traded company’s cash flow statement is almost the same as looking at real estate property’s cash flow statement. For example, if we look at Microsoft’s, we can quickly see their yearly cash flow is positive with the exception of this year (2005), which was highly negative in comparison. In this particular case, rather than completely dismiss the company without looking further, we can quickly see on the cash flow statement that the reason it had such a negative amount is that it paid a one time dividend of $36 billion dollars! There’s no way the cash flow cannot be affected by such a large dividend. However, on a normal basis, what we’re looking for is a consistent positive cash flow, just like a real estate rental property. Sometimes you’ll get the odd inconsistency, however overall you want positive consistency.

There are many other aspects of publicly traded companies that are almost identical to real estate rental properties (and commercial properties). However for the scope of this article we’ll stop here today. The idea is that if you take the same amount of time and pay the same amount of attention to your real estate rental properties as you do to purchasing stocks, you’ll probably come out ahead. If you don’t, then you probably should look at buy index funds because they basically mimic the market average. You will never beat it, but you will also never lose to it. For the astute investor who has the time and is willing to put in the effort, the rewards can be very positive, I can assure you from personal experience.

Before I end this article, just a couple of other quick tips for you when purchasing stocks. Firstly, pay careful attention to ROE (Return On Equity), it’s one of the metrics I use myself very religiously. This metric is basically supposed to measure the return on the value of the equity. So if you have an ROE of 15%, then the true business value (the value of the assets of the company) as suppose to increase by 15% for the year. Please note that you should calculate this value yourself, after you’ve made the adjustments we talked about above. For example, a company can say that its brand value is increasing by 50% a year while its real hard assets are actually decreasing by 35% in value each year, giving it an ROE of 15%. This could give you a nice looking positive ROE where in reality it’s very negative. I’ve seen this very legal trick played much too often.

The other tip is to avoid company’s that inconsistently take huge financial hits in down markets. Without naming names here, there are several companies over the last 2-3 years that have taken large losses, larger than they acquired in any one year. You can do this for many reasons, for adjustments, right-offs, etc. However some companies use this to absorb all their losses during a down market, when their stock price is already depressed. This way they can absorb losses for many years at one time while the stock is already low, after all it can only go so low. Then when the market picks back up, their profits are back, because the losses they should have claimed for that year are all used in that one bad year. This way they can have one extremely bad year and maybe 5 or so good years. However, if you average the company over say 7 years, then the rosy picture of the 5 good years no longer look so good. This is the same as someone who inflates their real estate rental income just before they sell. For example, they can pay all the regular expenses a year or two beforehand by buying all their supplies and stock piling them in anticipation, making the property look cheaper. The can also keep their entire inventory loss (renovations, etc.) and write it all off as one massive loss in one single year. There are many tricks that can be used to inflate the real price that can be used for any investment asset, including real estate and business. Real investors can generally see these, or at least have lots of red flags firing off left and right when they encounter them. I personally don’t believe in these tactics, but I do need to be aware of them to properly and correctly valuation all of my investment assets.

Lastly, if you are interested in buying stocks, then there are definitely some books I think you should at least read. If you’re only going to read one book, then I would suggest the The Intelligent Investor: The Definitive Book On Value Investing, Revised Edition by Benjamin Graham. It’s not a complete book on stock investing, there are more enhanced ways of valuating companies, but it’s a great start at understanding the fundamentals. After all, he’s the one who thought Warren Buffett how to invest in stocks. In any case, please find below a quick list I compiled of some of the books I found very informative (in no particular order):

The Intelligent Investor: The Definitive Book On Value Investing, Revised Edition

The Warren Buffett Way, Second Edition

The Essays of Warren Buffett : Lessons for Corporate America

Security Analysis: The Classic 1940 Edition

Reminiscences of a Stock Operator (A Marketplace Book)

When Genius Failed : The Rise and Fall of Long-Term Capital Management

Take On the Street: What Wall Street and Corporate America Don’t Want You to Know

Buffett : The Making of an American Capitalist

How to Lie With Statistics

Permalink to this article Discussions (0)

Mortgage Fraud is Expected to More Than Double this Year

Just like at the height of the dot com boom, being at the height of this real estate boom is causing real estate related fraud to become more and more prevalent. The number of FBI mortgage fraud cases has already climbed from 534 for all of 2004 to 642 cases for just the first half of this year alone (2005)! The FBI report also specified that 26 states have more serious mortgage fraud problems than others.

The biggest scam today is people artificially inflating the prices of houses. A recent article in Business Week (the September 05, 2005 issue) has an article entitled “The Accidental Mortgage Detective” which gives a fairly good explanation of how they do this. The general idea is to buy and sell the property many times over within a certain time period to people within the same group. Each sale is priced slightly higher, to give the impression that the property is quickly increasing in value. And this can be done with multiple properties in the same area, even within the same street to give the appearance of an even bigger local real estate market boom. Eventually the prices gets inflated enough that it is sold to the general public for a sizeable profit. As soon as the properties are sold, they quickly lose value because the value really wasn’t there in the first place.

There are many other fraudulent methods, such as using fake identities, fraudulent documents, etc., but I believe this one is the most important and least likely to be noticed, especially in a high market. Just another thing to pay attention to when purchasing your properties, especially considering that 80 percent of the cases involve industry insiders (people who know what they’re doing).

Permalink to this article Discussions (0)

Alan Greenspan Implies Some Housing Market Have Risen to Unsustainable Levels.

Alan Greenspan (the Fed Chief) suggested this week that “signs of froth have clearly emerged in some local markets where home prices seem to have risen to unsustainable levels”. Based on the fact that Greenspan always weighs his words very precisely because of the effects it has on the economy, this is not a statement to take lightly. Remember that back in the dot com craze, he also used similar carefully worded sentences to describe the stock market bubble just before it burst.

He’s also suggested that “the vast majority of homeowners have a sizable equity cushion with which to absorb a potential decline in house prices”. Again based on the carefulness of his wording, Greenspan is clearly implying that price adjustments are coming in the housing market, that prices will very likely drop! Also, in this same statement, he believes that most homeowners have sizable equity cushions to absorb the fall in prices which I don’t believe is correct. If you read further in this article from CNN Money, he also has some other statements that might suggest otherwise, which we’ll go over in this article.

Going back to Greenspan’s first comment suggesting that housing prices are in a bubble stage, this is very scary! First and most importantly because he acknowledges it. For Greenspan to suggest this is very significant, because he’s the one that sets the interest rates, because his very words can alter the economy. This man is very influencial because of his position and his knowledge and therefore careful attention must be paid to everything he says. Although he may be wrong at times, the effects of his decisions are felt worldwide.

He also states “The dramatic increase in the prevalence of interest-only loans, as well as the introduction of other, more-exotic forms of adjustable-rate mortgages, are developments that bear close scrutiny“. Reading between the lines as one must when listening to his statements, he’s basically saying that there are too many lending vehicles that have exceptionally high risk, as well as their increased prevalence. This is not new news to the people who come to this website, we’ve already talked about the large increase in interest only loans and their potential problems.

Christopher Low, the chief economist at FTN Financial also agrees with this interpretation with his statement: “It’s nice to know that the Fed is taking (exotic home loans) seriously. It looks like (Greenspan’s) trying … to squeeze out the speculative element in housing; they don’t want a repeat of the stock bubble”.

The only statement this week that I don’t agree with is that homeowners have a sizeable cushions to absorb the price downfalls. Firstly, we already know that a substantial amount of new homeowners are using interest only mortgages to purchase houses, which means that they have little to no equity down. We also know that many houses today are bought with 5% down. And we also know that “4/5 of the rise in mortgage debt resulted from people extracting their home equity“. What do they do with this equity? We can’t know for sure, but unless they invested it, it often used for consumer spending. For example paying off credit cards is considered consumer spending if the debt acquired on the credit card was through consumer spending in the first place. Therefore, we have just shown that a large percentage of the population has minimal cushionning.

One last thing to notice about Greenspan latest statement, he is quoted as saying “shocks should be largely absorbed by changes in prices, interest rates and exchange rates, rather than by wrenching declines in output and employment.” Again, based on his careful wording, if he is using the word “shocks” as a potential outcome, then I would seriously take head of that statement…

Permalink to this article Discussions (0)

Another 2-3% Drop in Housing Prices Coming

The Fed’s have again increased interest rates by another quarter point today, bringing interest rates to their highest in more than four years. What does this mean for the upcoming real estate bust? Based on my previous article about the effects of interest rates on real estate prices, for monthly mortgage payments to stay the same housing prices will need to drop by another 2-3%. So for example, that $300k property is now going to sell for $291k – $294k. Not that a huge difference, but it can quickly add up! At the level interest rates are today, each full percentage increase means about a 10% drop in housing prices to keep the same monthly payments!

Permalink to this article Discussions (0)

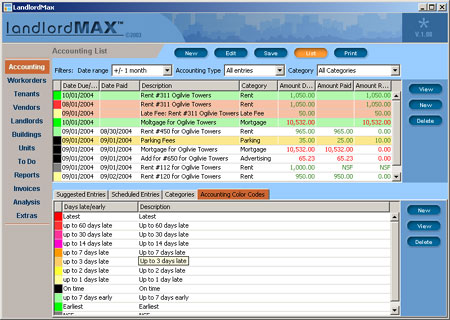

LandlordMax Property Management Software Status Update

Many of you on this site and on my company’s web site (LandlordMax Property Management Software) have been asking for more details about the next major release. When is it going to come out? What features will it have? And so on. Yes, the next major release is coming soon. Today’s entry is going to be all about it.

Working on this new version I suspect there will be some pleasant surprises for many of you. What we’ve done is take all the feedback and suggestions we’ve received through the Idea Initiative Program and used these to help drive what features made it into this upcoming version of LandlordMax. The feedback has been great! Thank you. And don’t think it’s ever too late to suggestion more improvements, we’re always excited to get feedback.

Before I go into details of what’s anticipated, here’s some quick previews and teasers: many new reports, report enhancements, table enhancements throughout, a new different database engine that is far superior, and so on. We’ve been working to bring this new release out as fast as possible, and it has posed some significant challenges. I’ll go into some of these today to give you a better idea of what’s going on and why were not likely to release it until at least the winter of this year (2005). Quickly, our most significant challenge and important change has indeed been the database engine. We believe we had to do this for several reasons which I’ll go into without hopefully getting too technical in this article.

Without further ado, let’s start looking at the status of the next LandlordMax Property Management Software release now!

LandlordMax Property Management Software Status Update

Firstly, and probably the most significant is the database engine change. We’re moving from an open source database called HSQLDB which is now being used to power the open source alternative of MS Word called Open Office to a database called Derby that was recently released to the open source community by IBM. This database was valued by IBM at $85 million! It has been sold and used by many highly valued commercial products and has been around for a long time. We’re very excited and proud to be able to provide Derby for you as your database engine!

From your perspective, there should be no visible changes at all with the new database engine change. If I hadn’t told you, you should technically never have known. If you did, then we didn’t do our job correctly of providing you with the easiest property management software in the market.

Why did we change database engine if you shouldn’t notice it? For several technical reasons which I will go into later. For now though, the quick benefits are that the database no longer has data limitations and is ACID compliant (don’t worry if you don’t know what that means, I’ll explain why it’s important to us later). The current database engine supposedly didn’t have data limitations, but we’ve recently found out that this isn’t necessarily true. Because of the way it’s been designed and built, the database is limited in data size to the size of memory it has allocated to it, more or less. Let’s take a quick somewhat technical look at that.

The current database offers something called Cached tables, which means that the tables can be written out of memory to the file system, allowing for large databases to be used. However, if you look carefully in the documentation it specifically states that the Result Set has to fit within the live memory. Without getting too technical, this basically means that if the data you are looking for is larger than your allocated memory space, then the database will return an error message saying it couldn’t complete the query. The good news is that virtually no one has encountered this yet, but I suspect it will happen in the future. To give you a scale of the limits, you would need to enter in about 50,000-100,000 entries on a normal installation to encounter this issue. Although this is more relevant to our larger customers, over several years this will eventually affect more and more people. Because of this alone, we’ve decided that it was better to act pre-emptively than wait until it became an issue, we don’t want anyone experiencing this. How horrible would it be to enter in many years of data for hundreds of properties only to have it eventually fail. No thank you!

The other major benefit is that it is a 100% ACID compliant database. ACID means: Atomicity, Consistency, Isolation, and Durability. The current database is not a fully compliant ACID database because they traded some of these requirements for speed. Because of this they were able to attain remarkable speeds in querying, however we’re now at the point where we believe it becomes more important to have a fully 100% ACID compliant database. The performance difference is almost negligible, 99.99% of you won’t notice, and if you do notice you have to be really quick!

The differences between the two databases in terms of ACID are:

Atomic: This means that you can do multiple database calls as if they were only one call, otherwise known as a transaction. This is important because if any single one of those calls fails, everything is rolled back to its original state. So for example, if you were a bank you could withdraw from one account and credit another as if it was one single database call instead of two (debit and credit). The benefit is that if you weren’t able to credit the second account (successfully complete all the calls), the whole thing would be cancelled and the money from the first account would be returned. The new database engine Derby is Atomic compliant. HSQLDB is not fully compliant, it’s possible to have “partially committed” transactions. Because the current version of LandlordMax doesn’t need to use transactions (each database call is currently atomic), this hasn’t been an issue. However, as we’re planning to offer a networked version next year, this will probably become more important soon enough.

Consistency: This means that the database will only write valid data to the database, otherwise it will rollback the transaction. As expected both databases support this.

Isolation: This means that multiple transactions occurring at the same time will not impact each other’s execution. So for example, if I start a transaction at the same time as you start another different transaction, both transactions should operate on the database in an isolated manner. That is, the database should either perform my entire transaction before executing yours or vice-versa. This prevents our transactions from potentially affecting each other in negative ways. The isolation property of a database however does not guarantee which transaction will be executed first, only that they will not interfere with each other. For the current version of LandlordMax this is not an issue since it is single user only. That is, there can only be one person using it at a time so it’s impossible to have two have conflicting calls.

Durability: This means that any transaction committed to the database will not be lost no matter what, it’s ensured through the use of database backups and transaction logs. The database will be able to restore itself in spite of any software or any hardware failures, no matter what! For us this is very important! With the first version of LandlordMax 1.00 we had some issues with HSQLDB sometimes not correctly shutting down because it’s not 100% compliant. Don’t be afraid, it’s very very rarely happens, and if it does happen it’s only the very last data you entered in the last milliseconds. Although this very rarely happens, it did happen. It was possible if you happened to be one of the really unfortunate people and shut down your computer at the exact wrong millisecond. Each new version of HSQLDB that we upgraded with each new version of LandlordMax helped reduce this, as well as some of the steps we took ourselves in the code. We were able to bring the number of failures down to 2-3 out of all our customers over the whole of last year, showing just how extremely rare it happened. That’s good, but not good enough for us! We’re expecting this to completely go away with Derby since it’s 100% ACID compliant.

The next biggest enhancement we anticipate seeing is the way the tables are displayed. One of the most requested feature enhancements we’ve received was to have some of the tables sorted slightly different, or to add new columns such as the priorities for the workorders. Well we decided to go one better than this and allow each and every table to be sorted by any column, including the reports just like in MS Excel. We also didn’t want to stop there, we’re currently investigating the possibility of letting you also choose which columns you want displayed rather than selecting them for you. We’ll of course offer a default, but you can manually change which columns will be displayed yourself.

While we were modifying the tables, we also wanted to go one step further, we want to add the concept of hierarchical tables, where you can collapse and expand sections of the tables. This way, if you have a report of accounting entries categorized by building, you can collapse all the buildings that don’t interest you so you only see their summary. We haven’t yet finished this feature, but we’re anticipating it will be available for the next version.

On top of that, we’re also hoping to offer searching functionality within each table. We haven’t decided if this is feasible because of screen real estate issues (there’s very little room left on the tabbed panels for lower resolution computer monitors which account for about 30% of our current customers). We’re working with our Graphic Designer Michael McGrath (which I highly recommend) to see if there is a way we can do in a very user friendly manner.

Unsurprisingly these table enhancements have been a technical challenge for us. Not just the implementation, but updating the sheer amount of tables we have in the software. Remember, we have hundreds of tables in the software. There’s over 100 reports alone!

Another significant change we anticipate is the ability to add your logo to the reports in an automatic way. Many property managers and companies have requested this and we’ve therefore added this ability. We’re also investigating the possibility of changing the titles of the reports, however we haven’t yet determine if this will make it into the upcoming version because of the complexity in presenting this in an easy to use way. I’ll explain in a little more details in the timeline section of this article why I say some features are anticipated and might or might not make it into the release, and exactly how we determine when and what will be released.

We’re also adding many more reports. Actually every release since the beginning has added more reports. This version will include more reports such as vacancy lists, rent rolls, etc.

Going on, we anticipate that all appropriate reports will now include graphs for quicker and easier understanding. For example, it’s much easier to quickly look at a graph to see how your cash flow has been doing than looking at a list of numbers in a table (or at least for some people). Although you need both, it’s amazing how much information simple graphs and pie charts can convey.

There’s also been other changes in the software. New fields have been added on some screens, the ability to print the amortization table, print multiple selected items from the list without needed to view them, performance enhancements, update notifications, etc.

When will the next major release of LandlordMax Property Management software be available?

Although I would like nothing more than to give an accurate and concrete date for when the next version will be released, I can’t. Unfortunately with software, it’s hard to determine when things will be done. I’d rather not be locked into a specific date forcing us to launch a version that has not been properly tested and is therefore not of the quality you expect from us. I’d rather postpone a release by a week or two, or whatever it takes, and get a better product out than one that is inferior, on time, and full of bugs. I think the most eloquent description of this philosophy was written by Joel Spolsky of JoelOnSoftware.com

That being said, we also don’t want to take our merry time getting a release out. Therefore we’ve adopted a semi-Agile development process. For those of you who aren’t familiar with the Agile software development process, I’ll try and describe it somewhat in a few sentences. Although it won’t give it justice, you’ll hopefully get the main concept.

Basically software development can be broken down into a list of requirements/features, that is a list of what needs to be done for the next version. Each requirement can be broken down further into a list of tasks, which is then distributed across a development team. The idea is that once all the tasks are completed for a version then you’re done your version.

Now there are many ways to deal with when the version will be released. One way is to determine which tasks need to be done, and adjust the date according to when the tasks are completed. Another way is to set a date and adjust the number of tasks to meet that date. Normally we prefer the second approach, but for this release we realized we would have to go with the first approach, adjust our date to complete certain key tasks. Then with the time remaining as we test and finalize the key changes, we will put in as many features as we can. Basically, this key task has become our critical path, the path that no matter what we need to take and we can’t finish before its completed. In our case, the critical path has become the database engine conversion. We cannot release until at least this task is fully completed and tested, no matter what. This is our most dependent task and it’s the one we need to watch the closest.

It wasn’t until very recently, just a month or so ago that we came up against the issue of database size. After investigating it, we needed to look at alternative database engines which took some time. In any case, no matter what database engine we decided to go with, we realized we would need to make changes to our code base. For example, without getting too technical, we took advantage of some of the database specific features of the current HSQLDB database engine, and worked around some of it’s difficulties. All these customizations need to be revisited. This also meant that our update and backup features would no longer work because they were specific to that database engine, more items to revise. We’re in the process of making these changes and more right now.

Actually, another key task is that we need to convert the database from one engine to another. That is, we cannot just simply copy and paste the content of one file to another, we need to provide a transition path that is invisible to our customers. Warning, if you’re not interested in the technicals, skip the text until you see the end of this warning. For example, we need to make a call to one database, say a select statement to get a list of all the accounting entries. We then need to call the other database to populate it with these same entries. That’s fine, but how does the software know this is the first time you’re running the new version and therefore needs to make the conversion (as well as which database engine to use). First, we check to see what files are in the database directory, this gives us a good indication of which database engine is in use. If it’s the HSQLDB database engine, then we run the conversion process, if not, we assume it’s already been converted. Now for the conversion process, we can’t just dump all the data into that database directory because once we’re done and we’ve confirmed that everything is ok, we then need to delete the old database files. There are multiple options on how to attack this task. Anyways, once the conversion is completed, we delete the old database files and move over the temporary new database files to it’s permanent position in the database directory.

You’ll notice that at this point, we haven’t talked at all the fact that we need to run LandlordMax with multiple database engines simultaneously and keep track of which is which, nor have we talked about the database specific calls. I won’t go into the database specific calls, but here’s a quick idea of at least one issue in the database conversion process. From which version of LandlordMax do we assume the conversion is coming from? Is it from version 1.00, 1.02, or 1.08, 1.08b, etc.? Each progressive update has different modifications to the database. In our programming code, we separated each database upgrade into another class, say DatabaseUpdate102, DatabaseUpdate108, etc. In the current version of LandlordMax, we have code that looks like:

Database100.createInitialDatabase();

if(database.isVersion100)

DatabaseUpdate102.process();

if(database(isVersion102)

DatabaseUpdate108.process();

This works very well because you can start from any version and you will see that the upgrade works. As a shortcut, as you can see in the code above, you can also create a new version by simply calling the same code. Now what happens if we change database engines? Does that mean that we leave the updates up to 1.08 to be created with the old version and always make the conversion after that, meaning that we will always have to ship with the old format? Probably not a good idea. Therefore we need to revised all this code to properly handle the database engine conversion.

Although these changes might look like trivial changes, they’re not. Again remember that we have some database specific calls in each of these that have to be modified. It’s definitely not impossible, it’s just that it takes time to be done right, and we want to do it right the first time!

End of technical warning

So now you have an idea of what’s involved in just converting the database. Once these changes have been implemented, we need to test them, and test them thoroughly. We need to test that the conversions work from new installations, from upgrades from each version (1.00, 1.02, and 1.08, 1.08b, etc.). We want to test every possible case to make sure that it works without any hitches and is unoticeable to our customers. To test this we therefore need to install and create entries for each version, the more complex and complete the entries the better the test results. For me to be personally satisfied that the new database will work 100% correctly, I suspect it will be sometime in the winter of this year (2005). Depending on how this goes, this will probably determine our release date. I’m currently anticipating it will be in December.

While I’m discussing some of the issues we’re facing, I figured I might as well also give you a better idea of what we’re facing when dealing with tables. As we’ve been implementing these we’ve found it’s a larger task than we originally anticipated. We quickly realized it would be advantegeous to us and you to purchase a component library from a vendor that does this, as well as a lot more. We calculated that everyone would be ahead. At this point in time I believe we’ve settled on which component library unless we encounter some unexpected issue.

Today, we have two main challenges remaining with the table requirements. The first one is dealing with the licensing of the component library. Although we believe we have chosen the component library and our test implementations look good, we still need to make sure the licensing fee to use the library is reasonable. We’re dealing with this right now. The second challenge is a technical challenge. In the first version of the software, we built a framework to assist us in developing tables that really accelerated the development of the software and allowed us to take some shortcuts because of this framework. Using a component library, we now have to do some conversion to our framework and test it for every case (and we have a lot of tables, over 100 just for the reports workarea) to verify that we’ve indeed properly converted each table.

Another challenge we’re still facing is the ability to print any column. This is not a technical issue, it’s a user interface issue. Currently each report (including table lists) are associated with a file in the reports folder which dictates how the table will be printed. In this file each column in each report is assigned a specific size (be it in millimeters or percentage of the page) to guarantee that all the printout looks good. The issue now is that these templates are no longer going to work because we don’t know ahead of time which columns will be printed, now how many. Then the question is; how much spacing should each column have? There are many options, of which we’re down to two right now. The first is that we manually ask you before printing. The second is that we use the percentages displayed in the table itself. We’re leaning towards the second option because option one makes the software more complicated to use and it doesn’t really give us much benefit (you probably want the columns on paper to look as close as possible to those on the screen). The second option of course is not without it’s own problems. Firsrlt, the print margins don’t match the printout. For example if you work on an 800×600 screen then you probably have more room on the paper than the screen. If you work on a 1600×1200 than you probably have more room on the screen than the paper. These are some of the issues we’re facing right now. These will be resolved before we release the new version, however at this time it’s still something we need to work through.

We’ve also been investigating the ability to add images to different workareas. Here the issue isn’t a technical one, it’s a user interface design one, that is how do we provide this feature in an easy and functional way. There are many options here, and unfortunately this is where the difficulties lie. For example, if we put a list of thumbnails in the tabbed panel for a building, then when you double click on it, does it fill in the tabbed panel? This probably won’t work so well for people who have smaller screens (800×600, which is about 30% of you). In these cases the image won’t be much larger than the thumbnail which is almost useless. Another option we came up with is to have a popup window for the images. In this model every time you double click on an image, you get a popup window with the image full sized. In terms of navigation, we could have this window close and popup again when you double click different images. This would work, but it’s kinda clumsy and it doesn’t fit with our philosophy of being the easiest. What about a forward and back button on the popup window? That might work. Another different option is to not use the tabbed panels and have a button in the top section of the screen bring up a thumbnail view of the images. Then from there you could navigate through the images. Right now we’re leaning towards either the last or before last option, and this is where having actually users test it will dictate to us which is better. Of course, there are other issues we faced with images but the major ones are not technical here yet.

We also looked into creating mailing lists. We looked for a component library that would assist us in this manner but unfortunately we couldn’t find one. If you know of a Java library that we could use for this, please email me. We started to implement this and that’s were we realized the sheer number of mailing label packages available in the stationary market. Therefore at this time it looks like we might offer a few standard pre-defined mailing label printouts. We’re not sure if we’ll offer the ability to generate custom labels for this version because of the complexity involved in designing such an interface and the time remaining until we release the upcoming version.

Other features that I can quickly talk about that we’ve already implemented include an auto-update reminder. In the past, when a new version of LandlordMax was ready, we would send out an email to everyone annoucing it so that they could benefit from their free upgrades. We found this method to be only semi-effective at best. Also, we don’t want our customers to be annoyed by emails from us, where we’re perceived as always sending out emails. Rather now what will happen is that if a new upgrade is released, the software will be smart enough to know and notify you when you next start it. If you don’t want to upgrade and not have it remind you, then that’s the end of the story. This way, we can guarantee that 100% of our customers know about the upgrade and we send don’t need to send any emails.

Another feature we added was the ability for the software, if you allow it to, to send us information in the rare cases that you do get an error. We’ve done this to allow us to continue to offer you the best, easiest, and most stable property management software on the market. This makes it much easier for you to pass on to us any errors you may encounter. The specific information that is going to be sent to us will be displayed on the screen, so that you can verify for yourself that no sensitive information is sent to us.

Conclusion

All in all, assuming we encounter no other major show stoppers like our database issue which substantially delayed our release date, as I mentionned before, we should be ready with the next major release sometime in December of this year (2005). As we get closer to the deadline, I’m sure you’ll start to notice more posts about LandlordMax Property Management Software on this blog. The good news is that if you buy it today (or after today), you get a year of free upgrades, which means you will definitely will get the next major release as part of your license. I’m going to go as far as to guarantee it right here that the next major release will 100% be within your license if you buy today or after today!

For those of you wondering when the next version after that will be released, rest assured we’ve already looking into this. Here’s a quick peak into what’s coming next year. Possibly a Mac OS version of LandlordMax. We’re also looking at offering a networked multi-user version of LandlordMax Property Management Software in 2006. Some other major features we’d like to offer are check printing, Quickbooks importing/exporting, and so on. The list is quite large and I’m sure we’ll get more precise with it as it gets closer to becoming a reality

Permalink to this article Discussions (1)

Can You Save Your Way to a $1,000,000 Dollars?

I recently had a discussion with a friend of mine on whether or not it’s possible to save your way to a million dollars or if it’s only possible to earn it. We talked about it from many angles, and yes it’s possible, but it’s very unlikely. You’ll have to live very cheaply for a long time, at least more much more cheaply than I care to.

So how did we come up with this finding? Like most of the other articles on this blog, I worked out the numbers. Today’s article is all about the numbers we worked out during that discussion. We’ll start from one angle and then work the what-if’s, how-to’s, and what-about’s after.

Ok, let’s start with a basic premise, let’s start with a salary. Where do we start here? To make things simple, let’s take the median Californian’s household salary of about $54k. Let’s assume a 25% tax rate straight off the top (which is probably lower than the actual rate, therefore working in our favor), leaving us with $40.5k in net income. Now, according to “The Wealthy Barber”, we should invest 10% of our income. Again to pad it in our favor, let’s make that 10% of gross (pre-tax income) rather than the net income. This means we will put away $5.400 a year into an investment instead of $4,050. As for the interest rate, let’s take an easy to measure interest rate, the current 30-year fixed US Treasuries rate of 5.375%/year. After 30 years, you would have $391,792.50 in your account. You’d be short about 61% of your goal of a million dollars!

Alright, now that we have a baseline, let’s start looking at these numbers in more detail, let’s change them, and let’s work with different assumptions. Ok, first, what if instead of 10% we saved 20%? What difference would that make? $783,585.05. Much closer but still over 21% short of our one million dollar goal. To make our goal of one million dollars we would need to put away $13,782.81 each year! Assuming a median income of $54k, that represents over 25% of gross income, or over 34% of net income! In other words, for ever dollar you take home after taxes, you need to put 34 cents into your investments, you need to live off of just under $27k a year. In California, assuming the rent is at least $1k a month (which is low), that means you need to live on $15k a year for everything (car, food, health, kids, entertainment, travel, etc.) for 30 years! That’s not very much, not much at all.

Ok, let’s look at it from another angle. What if we increased the interest rate to a more aggressive interest rate? Let’s take the average compound rate of return on stocks from 1802 through 1991, 7.7% per year. Assuming this rate of return with our original 10% of gross, would we make our one million dollars in 30 years? Unfortunately no, we would have made only $609,226.29, still shy over 39% of our targeted one million dollars. At that rate of return, we would need to invest $8,863.71/year, over 16% of our gross or almost 22% of our net. Although possible, I personally think that consistently investing 20% or more of the net income of the median family is probably asking for too much for the ordinary person. Investing 20% of 100k net in revenue is possible, but not for the median income family, it’s just too much.

Ok, so let’s look at it this way, assuming we want to save only 10% of our net income, the smaller of the two numbers, at the higher rate of 7.7%, then how much income would we need to produce? $88,637.11 in net income. Assuming a tax bracket of 25% again (it’s probably higher as taxes get progressively higher with additional income), then we would need to make $118,182.81 in gross yearly revenue!

The next question that comes to my mind is what interest rate would you need to earn on the median salary to have 1 million dollars after 30 years, assuming you’re putting away 10% of the net income of the median household income of $54k? You would need to earn consistently over 30 years 10.139% compounded interest a year. This is very doable, however it tells me that I most likely need to be a smart equity investor, a smart real estate investor, or start my own business. Chances are that I won’t attain my 1 million dollar mark (in today’s dollars) otherwise.

Now I can already see some of you saying that with inflation, one million dollars isn’t going to be anything in 30 years. Very true, but remember these calculations are in today’s dollars. That is, what you have in the bank (or in investments) then will buy the same amount of stuff then as it does today if you had a million dollars today. In actually, if you add inflation into the calculations, these numbers look even worse because you now have to reduce your real interest rate by 3.5% (today’s inflation rate). So if you make 7.7%, you’re actually only making 4.2%!

I can also suspect some of you will comment about increasing your income, and hence contributions, over time. Yes, that’s all true and all, and I completely agree. The thinking is that although you might not make over $100k today, you will tomorow so you should be able to play catch up by putting away bigger and bigger amounts. Yes, this is true, sort of except that there’s a catch! This is where the power of compound interest becomes very very interesting! Again, nothing speaks as well as working out the numbers, so let’s do just that.

Say I invest 10k in year 1 and do nothing for 10 years at 7.7%. I will end up with $100,003.52 after 30 years. Now, what if I invest $1k every year for 30 years (i.e. I invest for a total of $30k)? I will end up with only $112,819.69, a difference of about 10%! Wow! I invested 3 times as much money only to make 10% more! Catching up really didn’t help much.

Of course, in the example above we spread it out over 30 years. What if we do the same numbers, but over 10 years now? Get ready for a shock! For the initial $10k investment in the first year and nothing after I end up with $21,544.60. If I do the second scenario, investing $1.5k a year for 10 years, I end up with $21,706.79. I actually have to invest 50% more money to get the same final balance.

Let’s look at the effects of compound with one last example. Let’s say I have no money initially, so I invest nothing for 10 years. Then for the next 10 years I invest $2k a year, then for next 10 years after that I invest $3k a year, what will I end up with? $105,768.77! Wow! I end up with almost the exact same as if I invested $10k the first year. I have to invest a total of $50k to catch up to my initial $10k investment. 5 times as much money to end up with about the same final amount! That’s the power of compound interest!

You can play with the numbers, but you’ll find that as interest rates climb, the differences become even more staggering. Basically the idea is that you should let time be your friend. The longer you can compound a number the higher the return. Remember, compound interest is an exponential formula, so use its power to your advantage. Put as much as you can early on, it’ll make a world of difference tomorrow because its very costly to catch up later. Therefore using the argument that you’ll be making more money later and hence bigger investments is probably not a good one.

All in all, it’s possible to save a million dollars but the odds need to be in your favor. The math above assumes historical averages with median salaries. The math here does not deal with factors such as unemployment losses (you’ll probably have some bad months in your life, etc. The numbers also doesn’t deal with inflation which could substantially affect the results. Also, since these calculations don’t consider inflation, they assume that you’re gaining the full stock return which is completely untrue! For example, if you’re stocks went up say 10% this year, then you only really made 6.5% after adjustments for inflation. That’s right, you need to remove 3.5% for inflation. So for example if you had $100 invested and you made $10 for a total of $110, then you’re $110 can only buy $107 of equivalent goods as compared to your $100. As a more concrete example, if you could buy gold at $1/lbs, then in year one you could buy 100 lbs of gold. In year two gold would have gone up to $1.035/lbs because of inflation (assuming a 3.5% inflation rate), allowing you to buy only 107 lbs and not 110 lbs. This means that in reality our calculations are better than reality because we didn’t take this inflation into consideration.

Also, these calculations assume you never pay taxes on your investments. If you do pay capital appreciation taxes then the numbers change drastically. Therefore, a quick tip for this type of investing, try to pick investment vehicles that you can stay with for a longer term to avoid taxes because they can have drastic differences in these calculations as seen in my previous article on the affect of taxes on the real estate investment returns.

Now that you know most of the math what do you think? I personally don’t think it’s feasible to assume most people will be able to save and invest $1,000,000 dollars in 30 years. Not that it’s impossible, people have done it, but I don’t know that I want to live that type of financially squeezed lifestyle. Rather I think you’ll have to look at other avenues to increase your revenues (or rate of return) rather than just try to save your way to $1,000,000. You should probably look into investing wisely in equities, real estate, or building your own business. Basically, you need to look at something other than just putting money away in your mattress, because the honest truth is that in 30 years you’ll likely not have the $1,000,000 you worked so hard to save for, you’ll only have a fraction of that. I’m not saying don’t invest, I would never say that, actually I’m a very strong proponent of investing. All I’m saying is that you probably need more than just plain saving in your financial plan to get your $1,000,000.

Permalink to this article Discussions (22)

Home Prices Show Strongest Increase on Record

A recent quarterly survey by N.A.R. found (National Association of Realtors) that U.S. home prices rose at an annual rate of 13.6 percent. When you adjust the rise with inflation, according CNN Money, this is the strongest increase ever recorded! The biggest gainer being Phoenix, AZ.

When you compare this with the last article I published, it looks like the market is ripe for a bad downturn. Based on this last article which showed that the majority of Californian’s were over $70k short of income to support the median home, it’s hard to find where these gains are coming from. Earlier in the boom, interest rates really helped to explain the growth. Of course there are other factors like population growth, increased economic health, etc., however interest rates were probably the biggest driver to increased housing prices. Almost every 1% drop in interest rate increased the housing affordability by approximately 10% (based on the same monthly mortgage payments).

Today however the real estate market is completely different. Interest rates are now climbing thereby decreasing the mortgage amounts people can afford. The problem is that the lowering of interest rates created a bubble, where the prices were no longer determined by logic. If you ask the vast majority of people on the street just how much interest rates can affect real estate prices, they can’t tell you. Actually, if you ask these same people why housing prices have increased, they can’t give you a logical answer other than houses are a great investment and they’ll always increase (which isn’t true by the way). What’s happened is that emotions are now ruling the market, setting us up for a large real estate crash! The good news is that there are many things you can do to protect yourself.

10 things to do to protect yourself from the upcoming housing crash:

1. Generally avoid the real estate markets with the strongest gains. Although not perfectly accurate, it’s a good metric to start with. It’s the same principle as the dot com boom. The tech companies that has the largest and unexplainable gains where the most likely the ones that fell the hardest. Not always, but generally. The same is probably true for real estate markets.

2. If you’re going to buy a property, get a fixed rate mortgage of at least 10 years, preferably more. Based on the last 40 years of data, no real estate bust has lasted more than 7 years, so with a 10 year fixed rate, you should be protected from any interest rate increases that cause the market to crash. As well, this gives you a much more accurate idea of what your fixed costs will be. Therefore if you can’t get positive cash flow today, you should be able to keep that positive cash flow for at least 10 years.

3. Avoid interest only mortgages. Plain and simple, avoid them! These are very risky for most people because very few people are adept at handling the associated risk. If you can only afford your home this way then you’re buying too much home. You’re putting yourself at a high financial risk. Fortunately for real estate investors, and unfortunately for uneducated home owners, 31% of all new single family mortgages in 2004 were interest-only mortgages which will create great deals in the next few years.

4. Start hoarding your cash now for when the market does drop. This will be a great time to get properties much lower than today. Based on the housing affordability index of California, we could see drops as high as 56.7%. Who wouldn’t appreciate the possibility of purchasing properties as much as 50% lower than today!

5. If you’re going to pull out equity from your house, verify that you’re not over-financing yourself, that you have the same protections mentioned above as someone buying today.

6. Assumable and transferable mortgages provide you with more protection than not because if interest rates increase as expected, you can sell your mortgage with your property at today’s low rates. So for example, if interest rates climb to a historical average of 8-10% lowering the prices of homes, you can still sell your properties higher than the neighbors because you can also sell the mortgage with the property. That is you don’t have to decrease the price of your property by 30-50% to keep the same monthly mortgage payments, your transferable mortgage does it for you!

7. Whatever equity you pull out today, don’t use it to acquire consumer goods or pay off consumer debt. Use it wisely because you will need it tomorrow.

8. Assuming you went with a low down and a short term mortgage (either variable or 5 year fixed), start preparing yourself by saving as much cash as you can because if you have to refinance (say in 5 years), and you owe $200k on your property, but the price has dropped to bring it below that, say to $180k, then you will have to come up with some additional cash to cover your refinancing. In a bust real estate market, banks will probably not lend out 100+% mortgages. You’ll have to come up with at least that additional $20k, probably more.

9. Verify that all your properties are cash flow positive. Not that they shouldn’t be, but if they aren’t, it’s going to get a whole lot more difficult for you if you have a short term mortgage (5 years) or a variable mortgage as interest rates increase.

10. CASH IS KING! Start saving your cash now. This is where fortunes are made and lost, and fortunately for those with cash, this is where they are made! If you look at history, the common person buys at the peak of market booms and sells at a loss in market busts. Whereas strong investors, those that have lasted through many busts and booms, generally do the opposite. The near future will be one of those times, be prepared for it!

Permalink to this article Discussions (0)

Until This Week Californian's Were $70,480 Short of Income to Purchase a Home, It's Now Increased!

The California Association of Realtors, recently released a survey indicating that Californian’s where $70,480 short of income to afford a median home priced at $530,430, even worse for San Francisco Bay Area where the shortage in income is $102,230. These numbers assume a 20% down payment, with monthly payments for principal, interest, taxes, and insurances that are no more than 30% of the household’s total income. Based on the Fed’s interest rate hike this week, how much can this hike increase the income necessary to afford a home?

This week the Federal Reserve raised the interest rates by another 1/4 percent, with another raise expected on September 20 of this year. Assuming housing prices don’t change and an initial interest rate of 5%, that means that on September 20 (assuming another expected 1/4 percent interest rate hike), Californians will have to come up with an additional $133.29 a month, or gross income before taxes of another $205.27/mth. That’s $2,463.20 a year. In other words, the median affordable income will then be raised to $72,943.20 a year, an increase of salary of at least 3.4%.

If interest rates keep climbing, the real estate market is in for a lot of problems. Although $2,463.20 in additional income a year might not seem like that great an increase considering the scale of things, note that that’s just two minor rate hikes with more expected in the near future! And not only that, but according to BusinessWeek.com, 31% of all new single-family mortgages in 2004 were interest only! This means that many people are already financially stretched to their very maximum. And do remember, the numbers above are with a 20% down payment which is not nearly as common with interest only mortgages. Assuming the worse case, a 0% down payment and an interest only loan with the same 5% rate, the monthly amount is $2,210.12. Now add the two rate hikes to that rate and you get a monthly payment of $2,431.13, an increase of $221.01/mth, or $4,048.26 a year, almost double! And don’t forget that interest only loans generally have higher interest rates.

As you can see from these numbers, if interest rates continue to climb, we’re definitely going to see real estate housing prices drop. The good news is that you can plan ahead and protect yourself today. You can, for example, refinance your property and lock in today’s low interest rates for longer terms, the longer the better. And if you do purchase a new property, you should avoid purchasing at the upper limits or your budget and especially avoid interest only mortgages.

Now that we know the income required to own a home in California, let’s look at the numbers from another perspective. How far do real estate prices need to decrease to make housing affordable to Californians today?

Given the same 20% down payment, the mortgage amount comes to about $430,430 (20% is actually $424,344, but we’ve rounded it up a little to add some acquisition costs). Assuming the same 5.5% interest rate, we have a monthly mortgage payment of $2,443.93, making our yearly payment $29,327.16. At this point we have two options, we can determine how the survey calculated their numbers or we can make a rough approximation. For the scope of this article, we’ll use the rough approximation approach. Since we know that as we lower the housing prices some of our other numbers will also be relatively affected we can safely assume that the decrease will likely be less. As an example of such an affect, lowering the price of a property should also lower the insurance costs as it requires less coverage. Using our rough approximation, we can take the percentage difference of the required income of $124,320 and the shortage of $70,480 to give us an income shortage percentage of 56.7%.

What this means is that we need to drop the price of our mortgage by as much as 56.7% to make housing affordable today for Californians. Or in other words, the real estate housing price needs to drop from $$530,430 by approximately 56.7% to $300,753.81! That’s a large difference.

Odds are that real estate prices won’t decline this drastically because, as mentioned just above, if you add other factors such as inflation, insurance, taxes, etc., the drop will be a slightly less. How much less exactly, I’m not sure. But if you assume a drop 56.7% then you should be safe. And based on the past history of the real estate market, such drops have existed before. The good news is that no bust has yet lasted for more than 10 years. So again, if you’re going to buy in today’s market, buy with a long term fixed interest rate with the expectations that there will likely be a significant price drop before for some time.

Permalink to this article Discussions (0)

Recent Survey Shows Some Markets Heading for a Price Decline

As is evident by the articles on this blog, it’s no mystery that I’ve been a large proponent that real estate prices are exaggerate, that they have to fall. Well a new survey from PMI Mortgage Insurance Corporation shows that some of the US’s housing markets are increasing their chances for a price decline based on factors such as home prices, employment conditions, affordability, etc.

The study shows that more than one city has a higher than 50% chance of a price decline, cities such as Boston MA, Nassau NY, San Diego CA, San Jose CA, Santa Ana CA, Oakland CA. Actually, the national average is 21.3%!

The good news is that based on the article, the cities less likely to be affected by the bubble burst include cities such as Pittsburgh PA, Philadelphia PA, Indianapolis IN, Cincinnati OH, Columbus OH, Memphis TN, Nashville TN, San Antonio TX, and Seattle WA.

I was not able to find the details of how exactly they came up with these numbers, but they are interesting nonetheless.

Permalink to this article Discussions (0)

The Great Real Estate Dilemma

As you probably know from my previous real estate posts, I believe that we’re past due for a real estate bust. This week I came accross another very interesting article related to the topic by Dr. Steve Sjuggerud. I’m not sure I’m in full agreement with the article, but it does provide some very interesting arguments that are definetely worth reading.

For example, the graph above shows the prices of new houses adjusted for inflation. There are a few interesting points to notice about this graph. First, the general trend over time has been upwards. That is, as populations increase and space within cities become more condensed, prices have to go up, that’s the law of supply and demand. What’s also very interesting is that the prices have not always gone up steadily, there have been some drastic dips!

The delimma faced by today’s real estate investors is whether or not to buy, or to hold out until the bust when you can buy properties for much cheaper. Based on the fact that interest rates have nowhere to go but up, and the effect interest rates have on property prices, I know a lot of you out there are thinking of waiting it out. The reality is that a great investor can invest successfully in any market! The key is what you select and how you finance it. That’s the topic of this article.

If you look closely again at the graph above you’ll quickly notice that over the last 40 years that no dip has lasted 10 years. Although this graph is for new houses, let’s take the assumption that it applies for all housing (since conceptually it’s very similar). Therefore, assuming that you buy a property at the very height of a boom, if you can hold it for at least 10 years, than by all accounts you should be able to sell it at least the price you paid! At quick glance, that might not look so good, but take a second to think about it…

This means that no matter what the market, if you have at least a 10 year fixed mortgage at today’s interest and you can hold it for at least 10 years, you’ll make money (assuming you picked a good income property). At the very least you’ll have paid down the equity with your rental income. However, chances are that you will be able to sell it at a price higher than what you paid for at at least one point over those 10 years.

All said and done, it’s important for today’s investor to lock in their interest rates for at least 10 years and select positive cash flow properties. Actually, You should never purchase a negative cash flow property!!! Why would you? How can you call it an income property when you continually dump money into it? What’s the benefit of it? I’ve heard people say that they will make their profit when they sell. Why would you want to do this? You might need to make payments for who knows how many years before you can sell at a profit, maybe as much as ten years. How much profit will you really make? If I have a negative cash flow of say $200/mth for 10 years (which some people accept today), that’s $24,000 that you will need to put into your property over those 10 years.

|

Scenario 1 – $200/mth Negative Cash Flow |

|

|

Total cash flow payments over 10 years |

$24,000.00 |

|

Total Annuity earned on $24,000.00 |

$7,056.46 |

|

Total equity paid down |

$37,711.66 |

|

Total |

$6,655.11 |

|

Scenario 2 – Break Even Cash Flow |

|

|

Total cash flow payments over 10 years |

$0.00 |

|

Total Annuity earned on $24,000.00 |

$0.00 |

|

Total equity paid down |

$37,711.66 |

|

Total |

$37,711.66 |

|

Scenario 3 – $200/mth Positive Cash Flow |

|

|

Total cash flow payments over 10 years |

$24,000.00 |

|

Total Annuity earned on $24,000.00 |

$7,056.46 |

|

Total equity paid down |

$37,711.66 |

|

Total |

$68,768.12 |

Permalink to this article Discussions (2)

| « PREVIOUS PAGE | NEXT PAGE » |