Groupon – Back to Crazy Company Valuations

Just when I thought we were finally over the craziness of obscene IT company valuations of the 2000 dot com bust, I see Groupon’s latest valuation. $15 billion dollars for Groupon? That insanity! And although Groupon isn’t the only one getting ridiculous valuations, it’s definitely one of the worse along with Facebook’s $50 billion valuation from Goldman this month.

So let’s look at some numbers. And I’m not even yet talking about revenues or financials, let’s just look at the recent valuations. There’s no way the company’s growth is in line with the growth of its valuations.

In April 26, 2010, it was valued at $1.2 billion. This is when they said they expected to make $100 million for 2010. Shortly after this, Google offered Groupon somewhere between $5 billion to $6 billion, which they turned down. This month, based on their latest financing round of $950 million, Groupon has a valuation of $15 billion. Yes, that’s right $15 billion!

All this from a company that was spun off as recently as 2007, that only really started its web presence in late 2008. Now I’m not saying you can’t make large amounts of money in that amount of time, but creating $15 billion dollars of value, it’s not very likely.

But before I get too ahead of myself, let’s look at some concrete numbers, just to make sure I’m not the one who’s out to lunch here. Initially Groupon estimated it would make $100 million for 2010. It now appears that this number needs adjusting and they will claim upwards of $350 million in revenues. This is really good news, and it does explain why there’s so much hype for this company. My congratulations to Groupon for that kind of growth, it’s amazing!

But before we get ahead of ourselves, we need to realize that not all of Groupon’s revenues is theirs. Remember that Groupon has to pay up to 50% to the merchants. That means that their real revenues are probably closer to $150 million. In other words, the stated revenues are highly inflated, because although it’s revenues it’s not really real revenues. Unfortunately that’s going to help them get better valuations, especially if they become a publicly traded company. Most people just aren’t going to take the time to determine exactly how a company earns it’s revenues, they just quickly look at the numbers (if that, many just go with brand names or the hype associated to the a company). If you’re interested in more detailed analysis of Groupon’s revenues, Paul Butler has written a really good article. His analysis is pretty thorough and I agree with his findings.

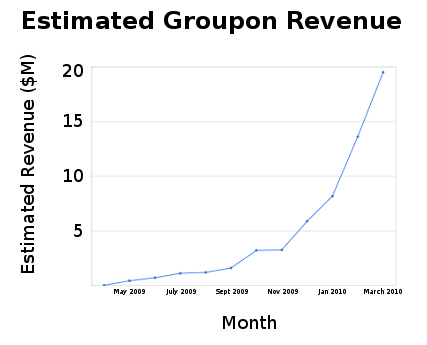

In any case, ignoring the issues with actual revenues, if you graph those revenues based on the available information, you get a revenue graph that pretty amazing (see below – source: Paul Butler). The growth curve is definitely something to write home about!

But even with that kind of growth, are the valuations worth it? Can it sustain that growth over time? Will the growth slow as the company grows? The bigger a company gets, the harder it is to maintain high growth levels. It’s much much easier for a $1 million dollar company to double in size than a $1 billion company. How often do $100 billion dollar companies double in size?

But most importantly, what is the premium paid for that growth today? In other words, how long do they have to continue that growth to get a reasonable valuation?

The best way to find out is to calculate the premium, for example using metrics such as P/E, and even that won’t really work because we don’t have enough information about Groupon (it’s a private company). But let’s go ahead and do a close enough comparison anyways, let’s do a P/R (Price / Revenue). Assuming my numbers are correct, that’s a P/R of about 43 based on total revenues. However if I make an adjustment to use their real revenues, the P/R skyrockets up to about 100.

Although we can’t do an accurate P/E calculation, we can do a quick ballpark calculation. Assuming 50% of that revenue goes to the merchant, we’re left with $175 million of revenues to make a profit from. Assuming another 50% for operating expenses (meaning a 50% profit which is very high and generous), that leaves us with $87.5 million in profits. Therefore as a quick ballpark, we’re looking at a P/E of 171 for Groupon!!! Is it just me, or is this P/E value all too reminiscent of the Dot Com Boom and Crash of 2000? And that’s just one metric. By the way, if we use a 35% cut rather than a 50% cut for the merchant, we still get a P/E calculation of 132. This is just as insane as 171.

And if metrics aren’t your cup of tea, maybe we can do direct comparisons of Groupon to existing companies with similar market valuation? Here’s a small list of companies valued similarly to Groupon.

| Company | Valuation | Revenues |

|---|---|---|

| Adobe | $17.03 billion | $3.8 billion |

| Best Buy | $13.93 billion | $49 billion |

| Staples | $16.83 billion | $24.2 billion |

| Symantec | $13.83 billion | $5.98 billion |

| McGraw-Hill | $11.54 billion | $5.95 billion |

| Groupon | $15 billion | $0.350 billion |

Do you know what the first thing I noticed in this list, not one of these companies has revenues below a $1 billion other than Groupon, or even several billion! Although I have to admit I haven’t done the most thorough search, I don’t think you’ll find many, if any, stocks with these kinds of valuations in the public market. The numbers just don’t make sense.

The premium on Groupon is such that you’re paying for it as though it’s already a very large and mature company. That is, the built-in premium on the company is so large that it would have to continue the same level of growth for at least a decade or more. The odds against that are extremely low.

I also believe every single company on the list above is worth more than Groupon. But don’t take my word for it, let’s look at another comparison. Let’s look at the valuation to revenue ratios. From our list above, the best (largest) ratio (other than Groupon) is from Adobe at 4.48. Groupon’s ratio is 42.85! That’s 10 times more than the best ratio on that list. If you can find a company that has even close to that ratio, that’s listed on either the Nasdaq or NYSE, then please let me know!

Using the 4.48 ratio, which is the best ratio (highest premium), that would make Groupon worth $1.5 billion. If we use the lowest ratio (Best Buy with a 0.28 ratio) that would make Groupon worth $98 million. Which means that Groupon should be valued anywhere from $100 million to a max of $1.5 billion according to this list. I agree the sample size isn’t very large, but this is a fairly common sample of companies at these valuations. As you get to valuations of this scale, the premiums start to diminish. It’s understandable for smaller companies that can grow faster, but at these scales it’s much more difficult to get similar growth rates for larger companies.

Anyways, do any of these companies really compare to Groupon in terms of value? If someone gave you the option of getting $x of stocks in only one of these companies, and you had to wait at least 3, 5, or even 10 years to sell, which company would you select? Is Groupon worth 10 times as much as those companies? I personally don’t think so. Do you?

Permalink to this article Discussions (1)